Update on 30/09/2024: Since the writing of this article, Trigg Minerals have acquired the advanced Wild Cattle Creek mine and deposit. Please read our article here: Trigg Minerals Acquires Advanced Antimony Deposit

ASX: TMG

Our investment pick:

Trigg Minerals

Low market cap, multi-commodity exposure

Trigg Minerals is strategically positioned to offer investors exposure to potential discoveries of antimony, gold, and copper across its portfolio of projects.

The company maintains a sizeable landholding with exposure to Gold and base metals in a prolific neighbourhood through it’s Drummond Basin projects in Queensland.

The basin has produced over 20 Moz gold and 14Mt of volcanic massive sulphides (Copper, Zinc, Lead).

In response to the recent decision by the Chinese government to restrict Antimony exports, Trigg has moved quickly to secure tenements in New South Wales, encompassing historically productive Antimony mines and highly prospective geology for new Antimony discoveries.

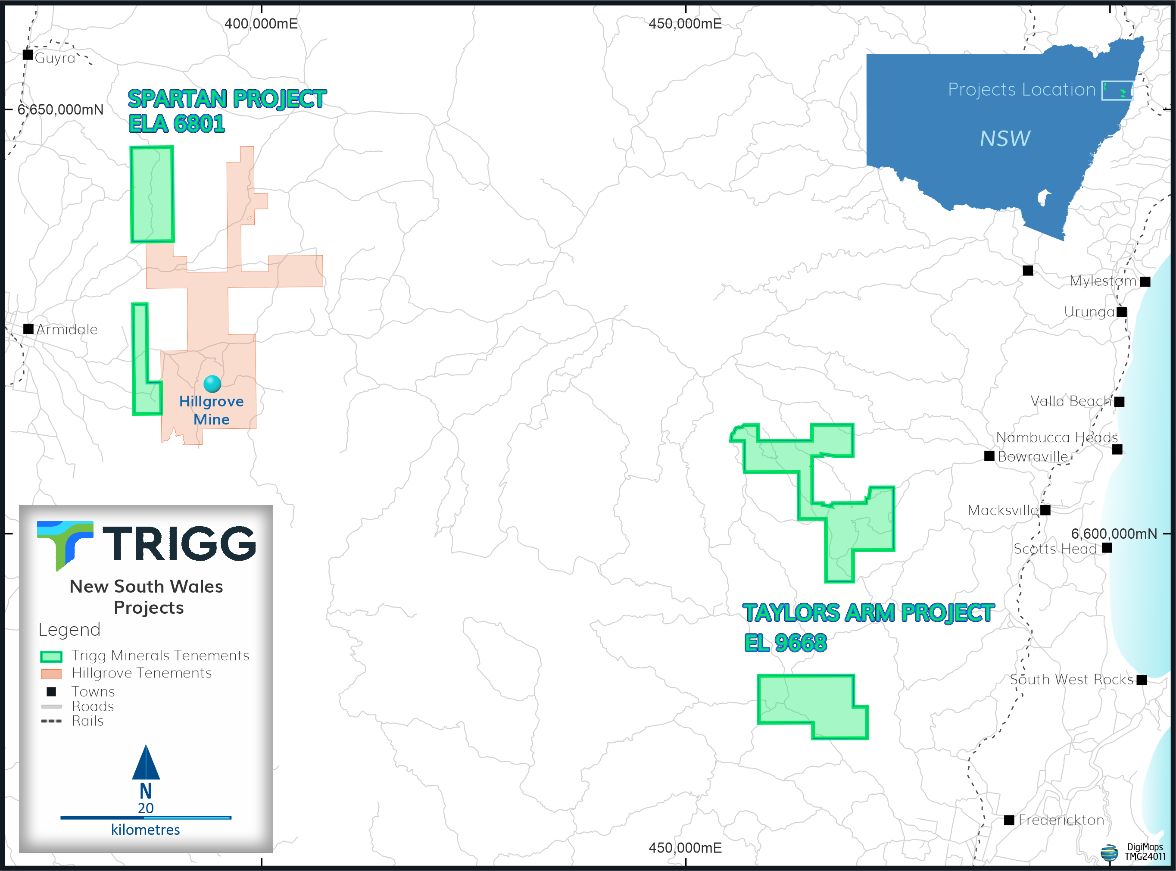

Trigg announced to the market the acquisition of the Spartan and Taylors Arm Antimony projects. The acquisition will provide investors with exposure to potential Antimony discoveries, which is an increasingly critical strategic mineral.

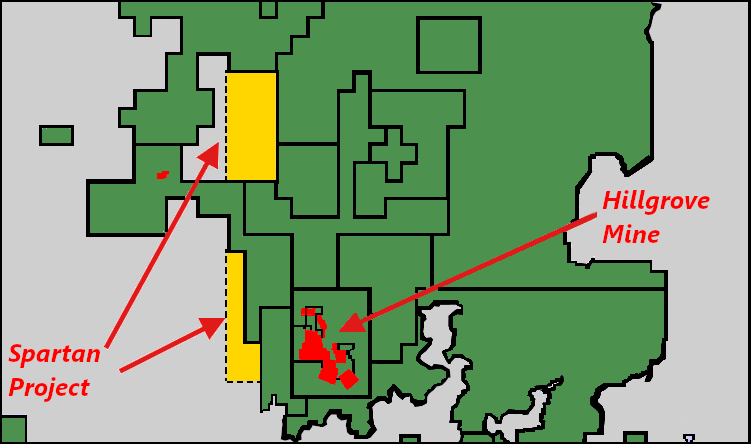

Spartan Project: Proximal to Hillgrove Gold-Antimony mine

The Spartan project is located immediately adjacent to Larvotto Resources’ (ASX: LRV) property, which includes the Hillgrove Gold-Antimony mine.

Hillgrove, once an active antimony producer, is currently undergoing a definitive feasibility study (DFS) with plans to resume production.

The Spartan project is believed to be on the same geological formation that hosts the Hillgrove mine.

The Hillgrove Gold-Antimony deposit mineral resource estimate (MI+I) contains 93kt Sb @ 1.3% in addition to 1.03 Moz of Gold @ 4.4 g/t. Hillgrove has Australia’s largest deposit of antimony, ranking in the top ten globally.

The only currently operating antimony mine in Australia is Mandalay’s Costerfield mine, which accounts for 2-4% of global antimony supply.

Taylors Arm Antimony Portfolio

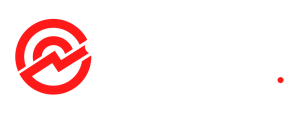

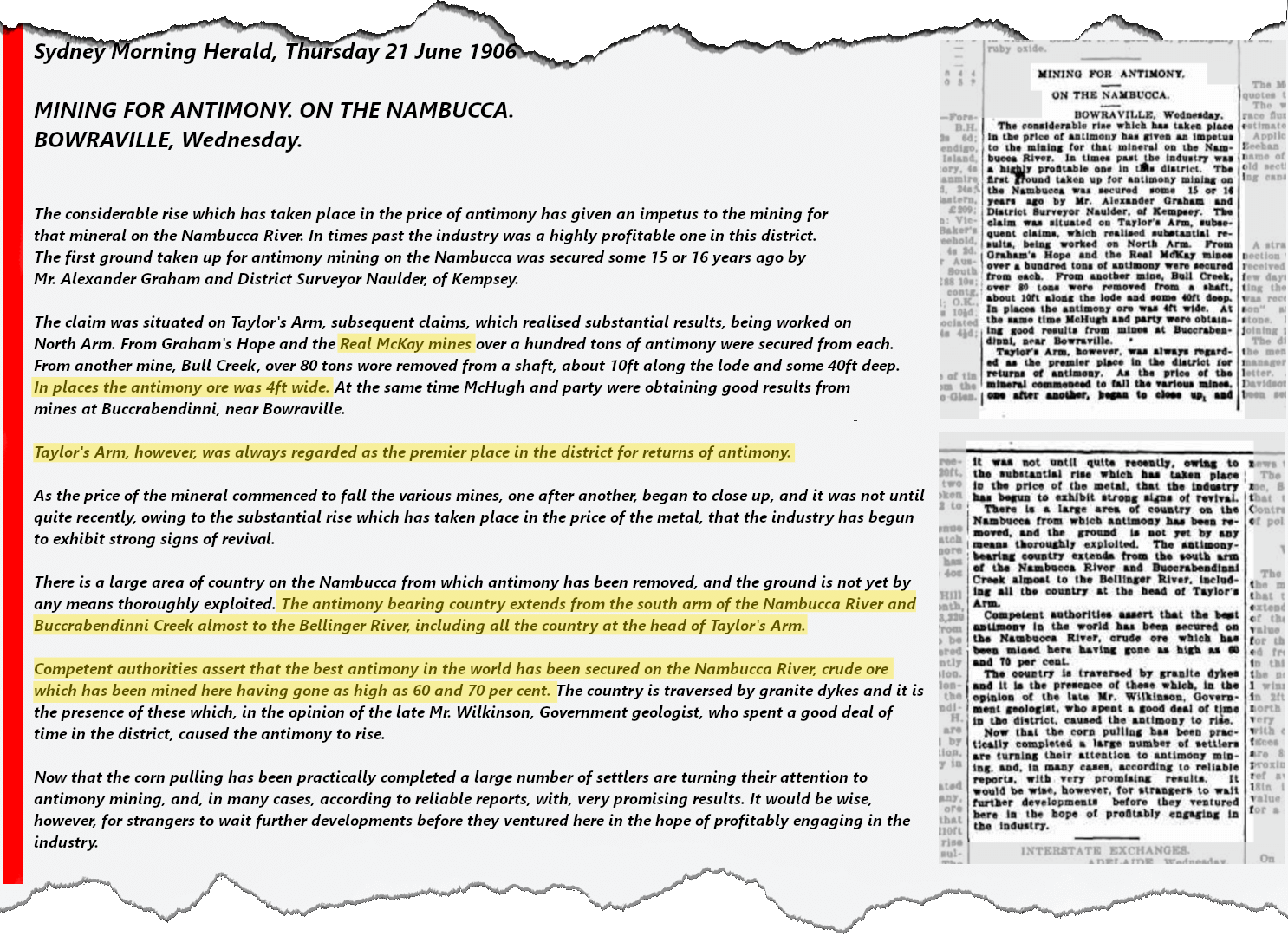

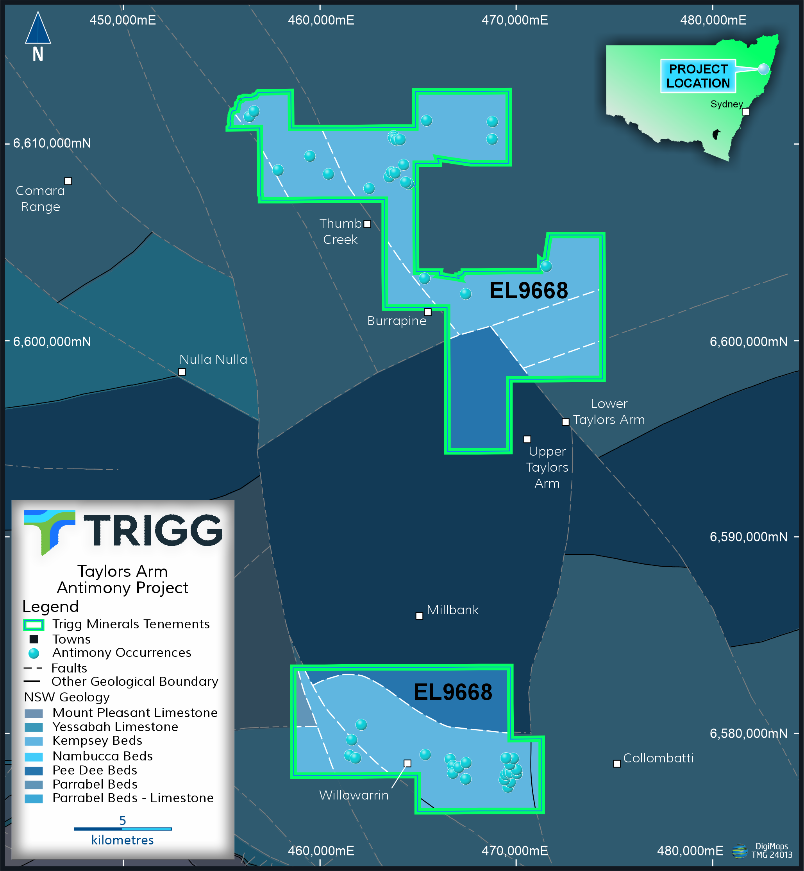

The Taylors Arm Antimony portfolio contains numerous historical producing high grade Antimony mines and claims that have not been subjected to modern exploration methods.

Trigg has the opportunity to identify and define additional resources at these mines that were previously overlooked due to low-price environment or weak demand for Antimony.

The acquired landholding within the Taylor’s Arm Antimony province includes 71 historical mines that have produced high-grade Antimony. In addition to the prominent historical mines outlined above, the landholding includes the following mines and claims with grades up to:

- Bowraville – 18.3% Sb

- Kia Ora Mine – 17.7% Sb

- Bradley’s Mine – 32.8% Sb (mean value of 20 assays)

Located within the New England Orogen, The Taylors Arm Antimony province experienced periodic Antimony production from the late 1800s to the early 1970s, yielding significant economic grades of Antimony.

Why Antimony?

Antimony is a scarce metalloid with critical uses in areas such as:

| Application | Description |

|---|---|

| Flame Retardation | Antimony Trioxide (Sb₂O₃) does not have flame retardant properties on its own, but when combined with halogenated compounds, it creates a synergistic effect that imparts flame retardancy. This formulation is used in plastics, textiles, rubber, and other materials. |

| Ammunition | Antimony is alloyed with tin and lead to produce harder bullets, reducing lead residue inside a barrel's rifling, thereby maintaining accuracy. It is also a key material for armor-piercing (AP) ammunition. |

| Military Applications | Utilized in various military applications, including night vision goggles, infrared sensors, precision optics, semiconductors, and other electronic components. |

| Glass and Solar Cells | In photovoltaic glass, antimony compounds like antimony trioxide (Sb₂O₃) improve optical properties and increase transparency, allowing more sunlight to reach solar cells. Antimony sulfide (Sb₂S₃) is used as a light-absorbing material in thin-film solar cell technologies. |

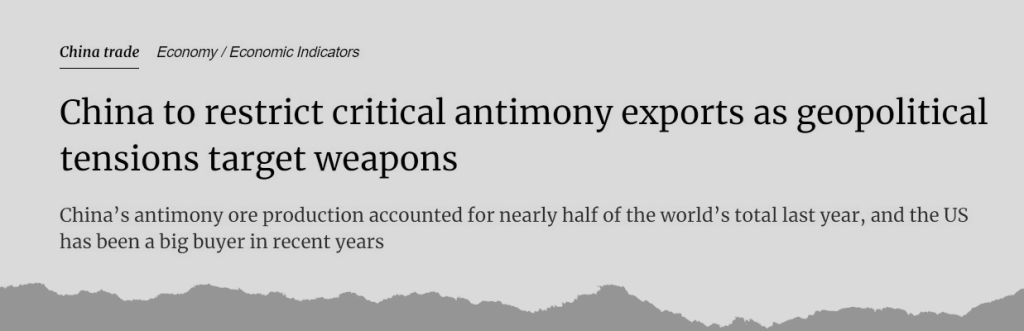

On August 16th 2024, China announced that they will implement export controls on antimony products from Sept. 15 2024. Beijing cited national security concerns, adding to existing measures imposed by Beijing since last year to curb exports of strategic minerals.

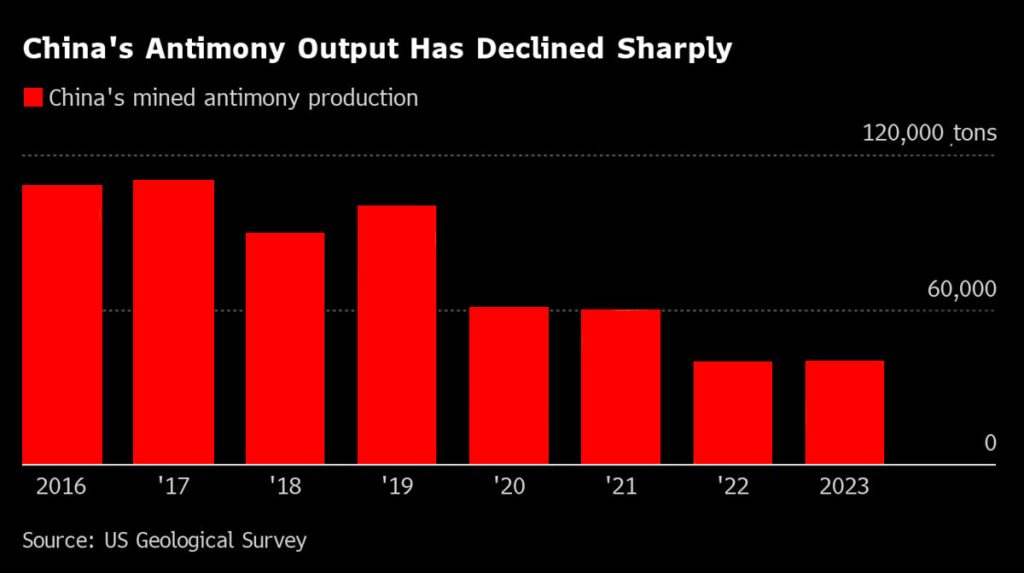

China is the largest producer of antimony, accounting for 48% of global mine production in 2023, followed by Tajikistan at 25%, U.S. Geological Survey (USGS) data showed.

Antimony ingot prices trade at record highs

The Antimony production in China has declined to 40,000 tons in 2023 from 61,000 tons in 2020 as a result of falling ore grades and more stringent environmental requirements.

| Country | Mine Production (Tonnes) | Percentage of Total Global Production (%) |

|---|---|---|

| China | 40,000 | 48.01% |

| Tajikistan | 21,000 | 25.21% |

| Türkiye | 6,000 | 7.20% |

| Burma | 4,600 | 5.52% |

| Russia | 4,300 | 5.16% |

| Bolivia | 3,000 | 3.60% |

| Australia | 2,300 | 2.76% |

| Mexico | 700 | 0.84% |

| Iran | 500 | 0.60% |

| Kazakhstan | 300 | 0.36% |

| Vietnam | 250 | 0.30% |

| Laos | 220 | 0.26% |

| Pakistan | 80 | 0.10% |

| Kyrgyzstan | 40 | 0.05% |

| Guatemala | 24 | 0.03% |

| Canada | 2 | 0.00% |

| United States | 0 | 0.00% |

| Total Global Production | 83,316 | 100% |

The current Ukraine-Russia and Israel-Palestine conflicts have increased the importance of Antimony as a strategic mineral due to it’s numerous military applications, ranging from ammunition to essential equipment.

Recently, the United States and European Union countries announced they were facing severe ammunition shortages due to on-going supply to Ukraine. China’s decision to restrict exports and remove 48% of the world’s supply will place significant pressures on the production of ammunition and military items in Western countries.

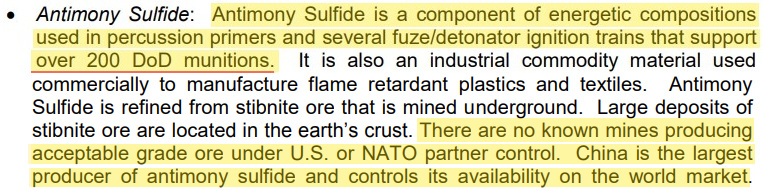

Per the annual industrial capabilities report to congress from the under secretary of defence for acquisition, technology and logistics:

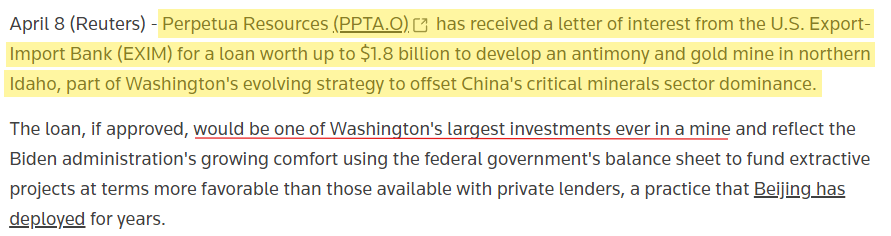

To this end, the United States recently announced the intention to provide funding through a loan to Perpetua Resources to develop their Stibnite Gold-Antimony Project in Idaho.

In addition to the EXIM loan offer, Perpetua Resources has received $59.4m USD in Defense Production Act Title III funding to date.

Date: 20/09/24

Ticker: TMG

SOI (undiluted): 468,001,304

Share price: $0.02

Market cap (undiluted): $9.36m

Cash (approx): $2.35m

EV: $7.01m

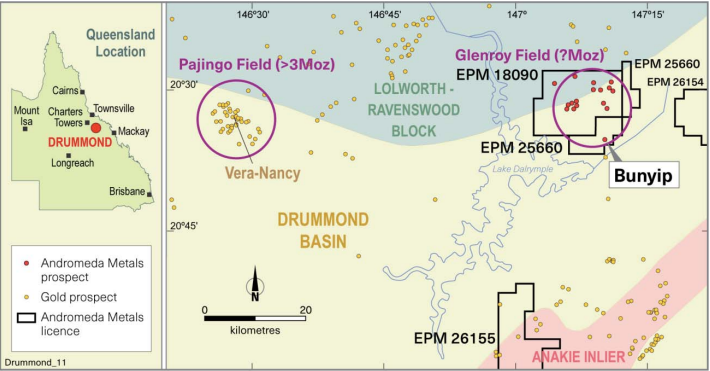

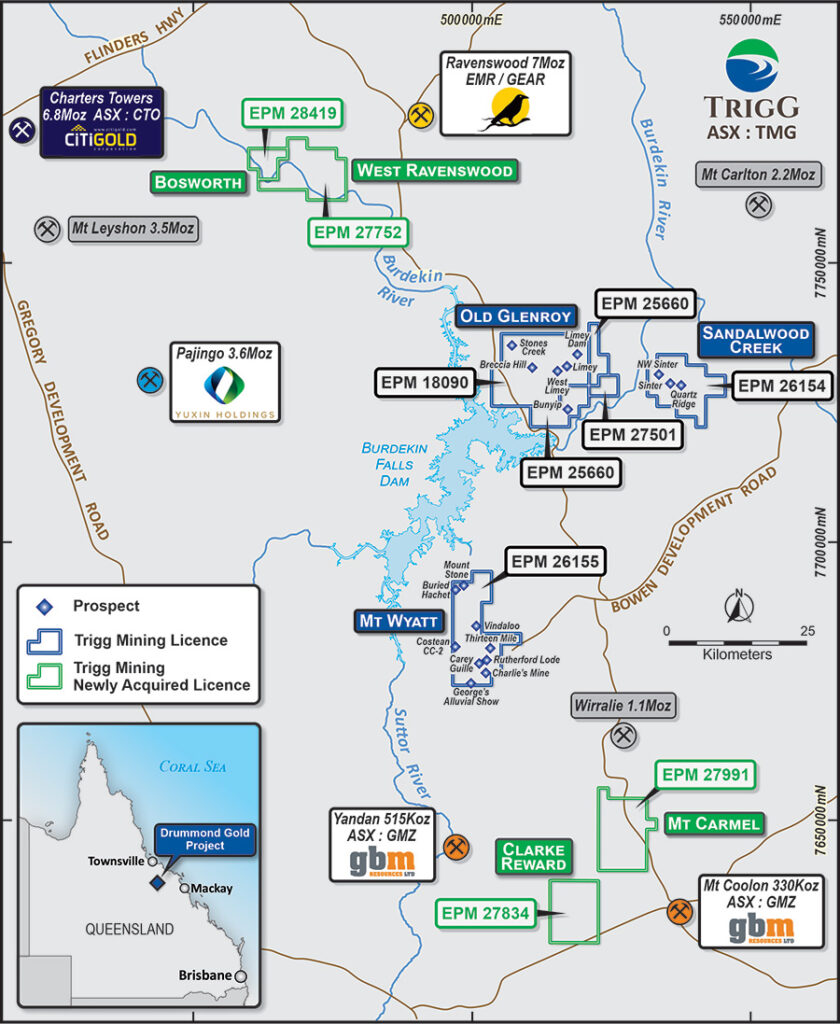

Drummond, Clarkes Reward, Mt Carmel, West Ravenswood and Bosworth Project

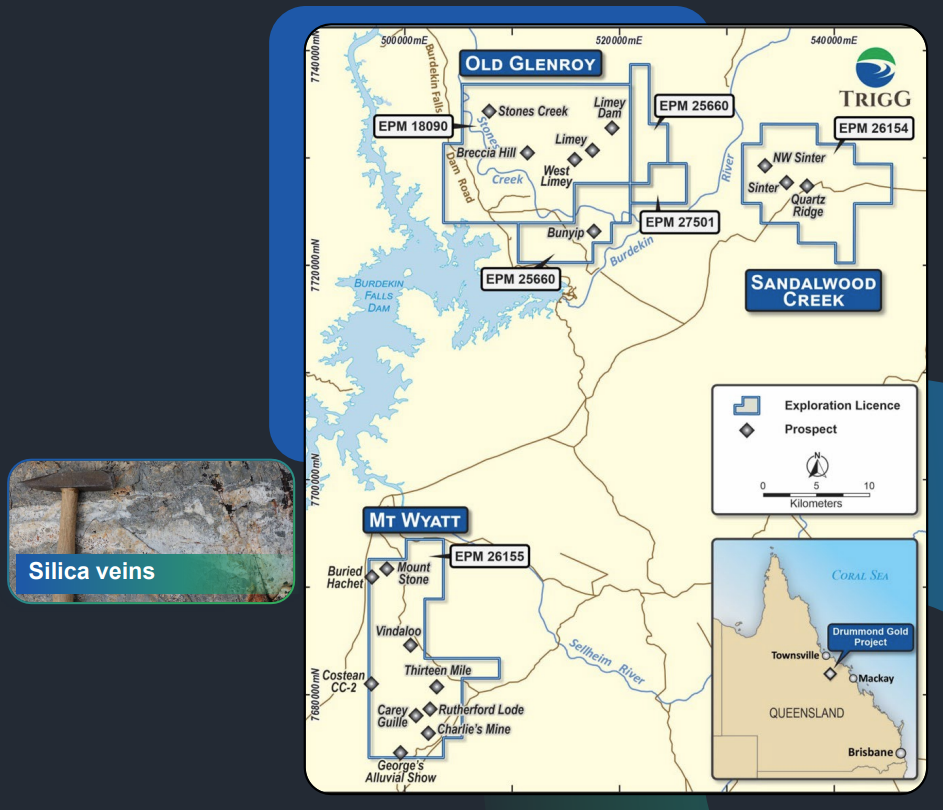

The Drummond project consists of five exploration projects totalling 540km² of prospective tenure in the Drummond basin. The project area has demonstrated potential for epithermal and intrusion related gold deposits. The Drummond project has five targets worked up for potential drilling campaigns – Limey, Breccia Hill, Quartz Ridge, Bunyip, Charlie’s mine.

The project was previously part of a joint-venture between Halloysite-Kaolin aspirant Andromeda Metals (ASX: ADN) and $8.6 billion market cap gold producing mammoth Evolution Mining (ASX: EVN). To date, the project has had $6m in exploration data generated and available to Trigg Minerals, assisting in the delineation of five targets.

Outcropping gold-bearing veins of the same style and scale to the nearby Pajingo (>3Moz) gold-silver deposit occur within the project. Vein textures at several prospects in the project suggest the system is largely preserved, and that the most prospective level for gold mineralisation remains untested by drilling.

Bunyip

- Intercept of 3 metres @ 3.42g/t gold and 6.7g/t silver from 7m, including 9.16g/t gold and 18.1g/t silver from 9m during drilling undertaken by Evolution Mining in 2019.

- Previous drilling by Andromeda in 2018 of 23 holes for 1906 metres encountered:

- 2m @ 4.36g/t gold from 8 metres

- 2m @ 1.66g/t gold from 13 metres

- 1m @ 2.32g/t gold from 61 metres

- 4m @ 5.15g/t gold from 7 metres

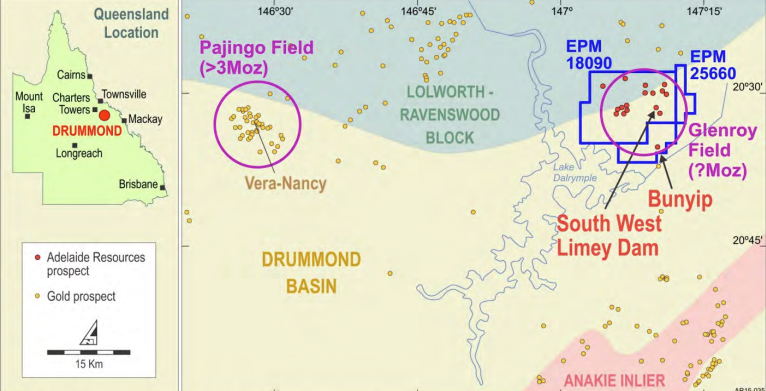

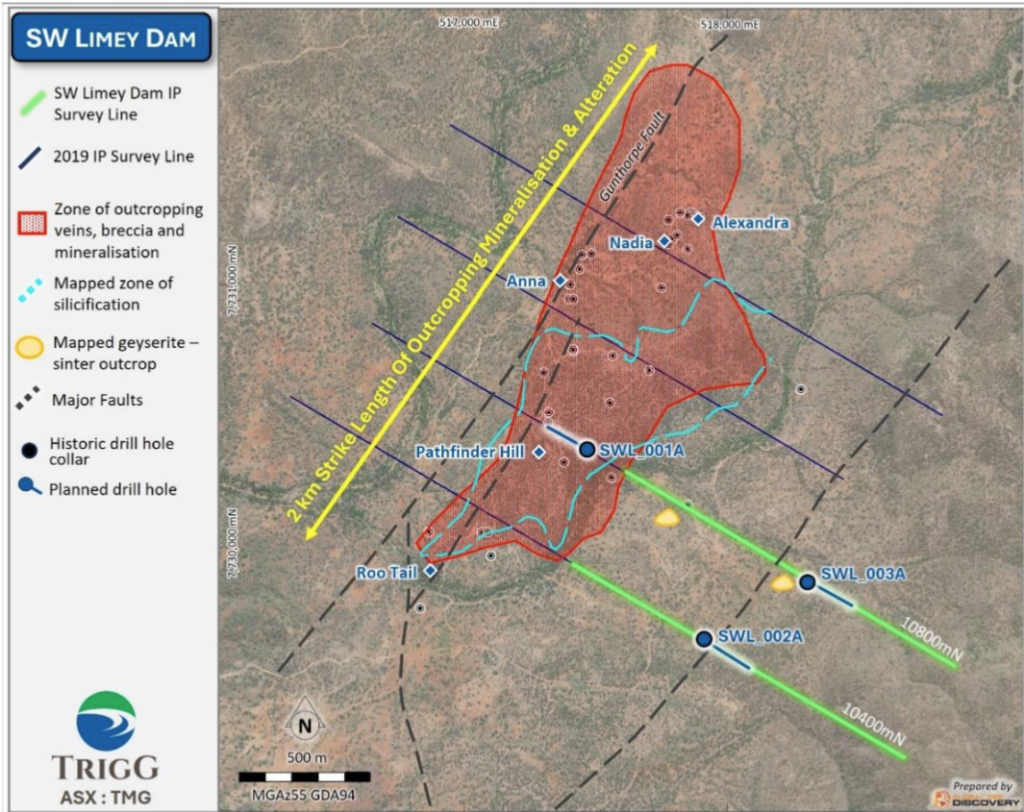

South West Limey Dam

- Gold-bearing epithermal prospect

- Large surface arsenic anomaly, southern part of the prospect

- Field review by Dr Gregg Morrison (epithermal specialist) interprets the South West Limey Dam prospect to be a classic hotspring geothermal-epithermal system

- Hosts low-sulphidation epithermal quartz veining and silica sinter along 2km strike length

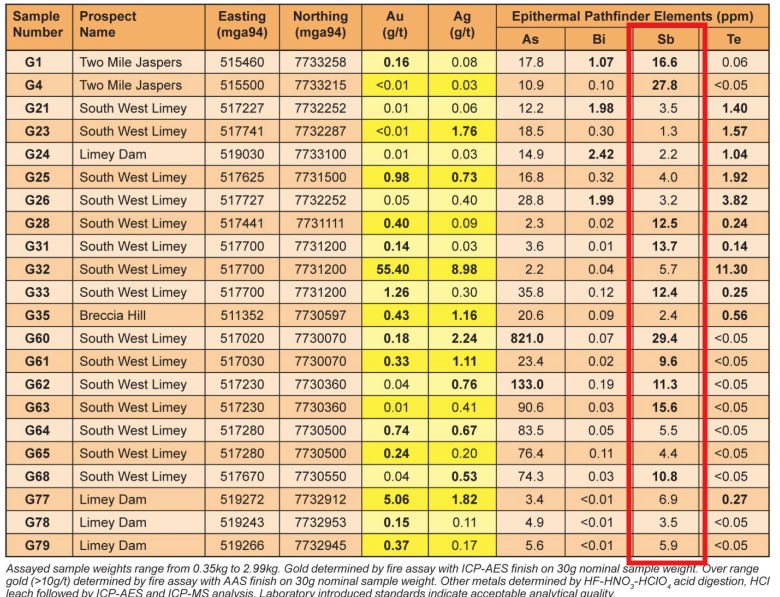

- High gold and silver values of up to 55 g/t Au and 9 g/t Ag in historical rock chip sampling

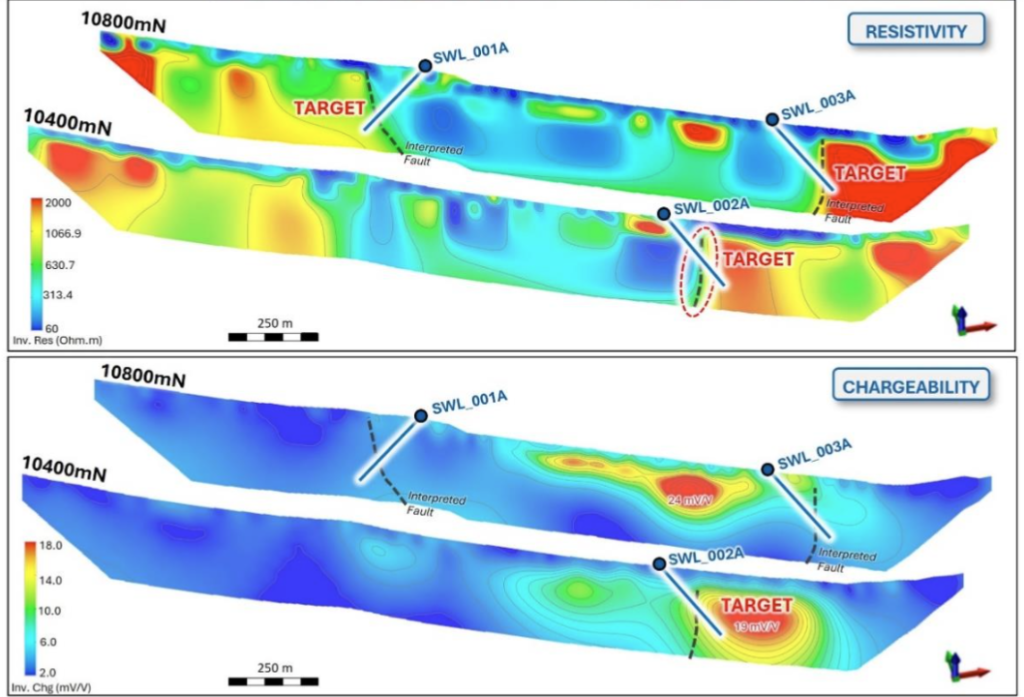

- Strong chargeability and resistivity anomalies from new and existing IP data indicates preserved epithermal system

- Untested epithermal quartz vein structure to the east of outcropping veins.

- Strength and characteristics of the anomalies bear a striking resemblance to the IP signature of the mineralised epithermal structures at the >4Moz Pajingo low sulphidation epithermal deposit, approximately 60km west.

- Newly identified geophysical targets have determined three high priority drill holes which are currently being drilled by Trigg.

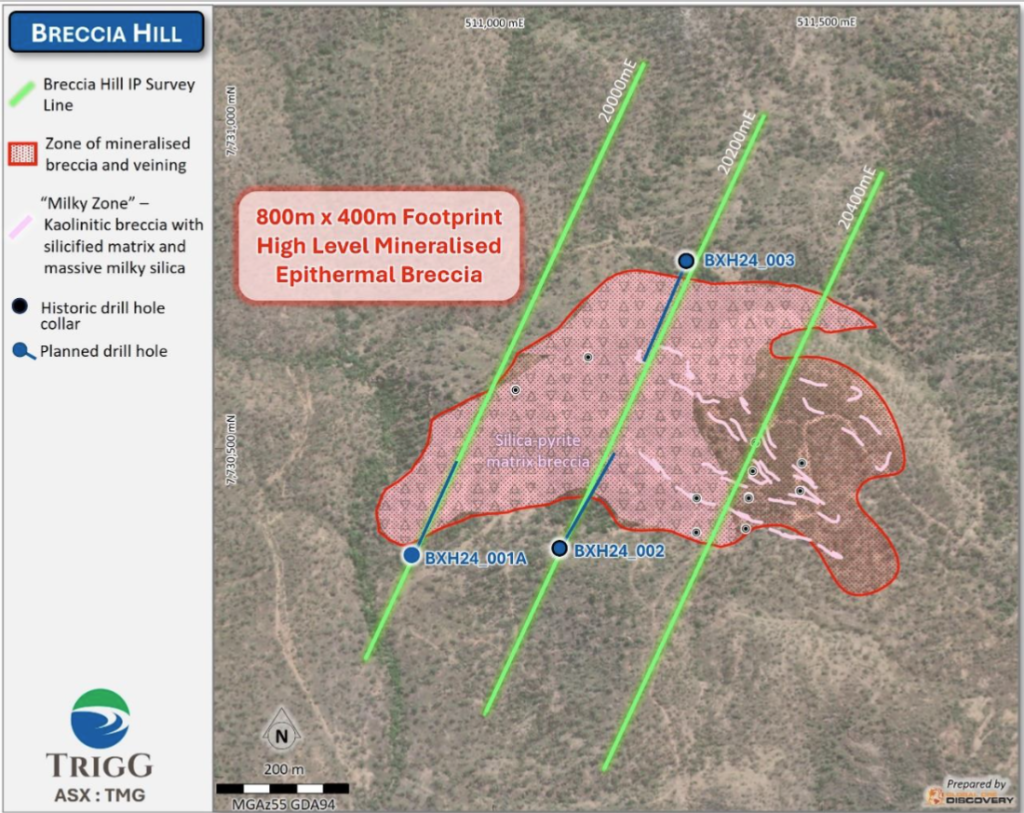

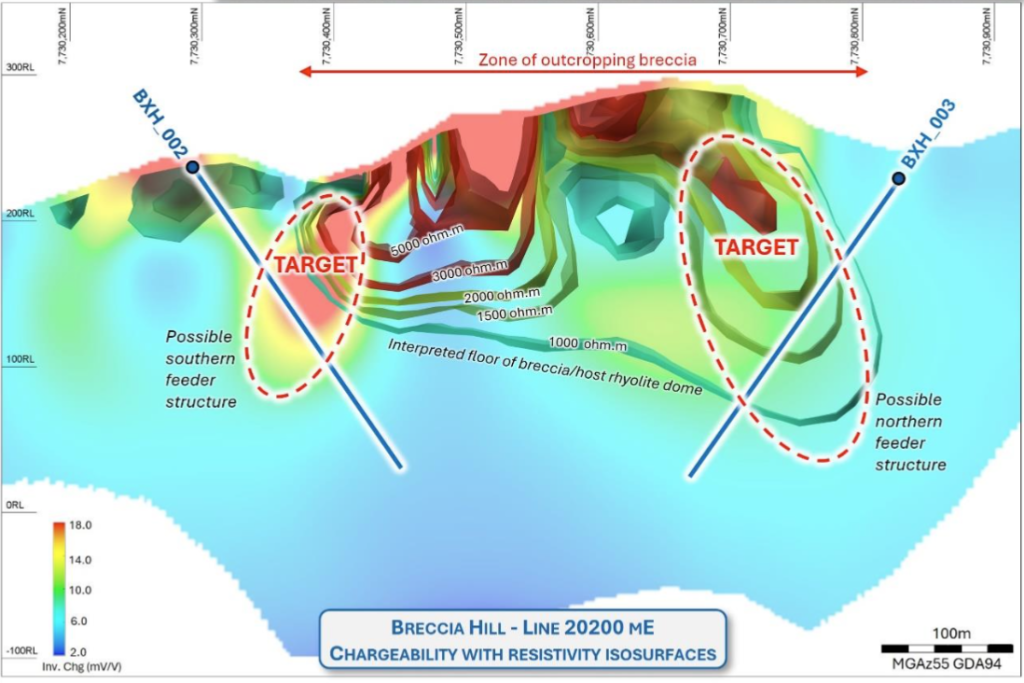

Breccia Hill

- The program has identified resistivity and chargeability anomalies consistent with deeper ‘feeder’ structures

- Epithermal gold prospect which has recently been subject to a geophysics program by Trigg

- Significant zone of Breccia contained within a Rhyolite dome

- Similar geological and geophysical characteristics to Twin Hills-Lone Sister epithermal deposit (~1 Moz) in the Drummond Basin

- Mostly shallow historical drilling that did not test the potential for deeper feeder zones to contain higher grade gold

- Pole-Dipole Induced Polarisation (PDIP) survey demonstrated promising resistivity and chargeability anomalies beneath the outcrop

- Feeder structures to be drill tested by Trigg 2H2024.

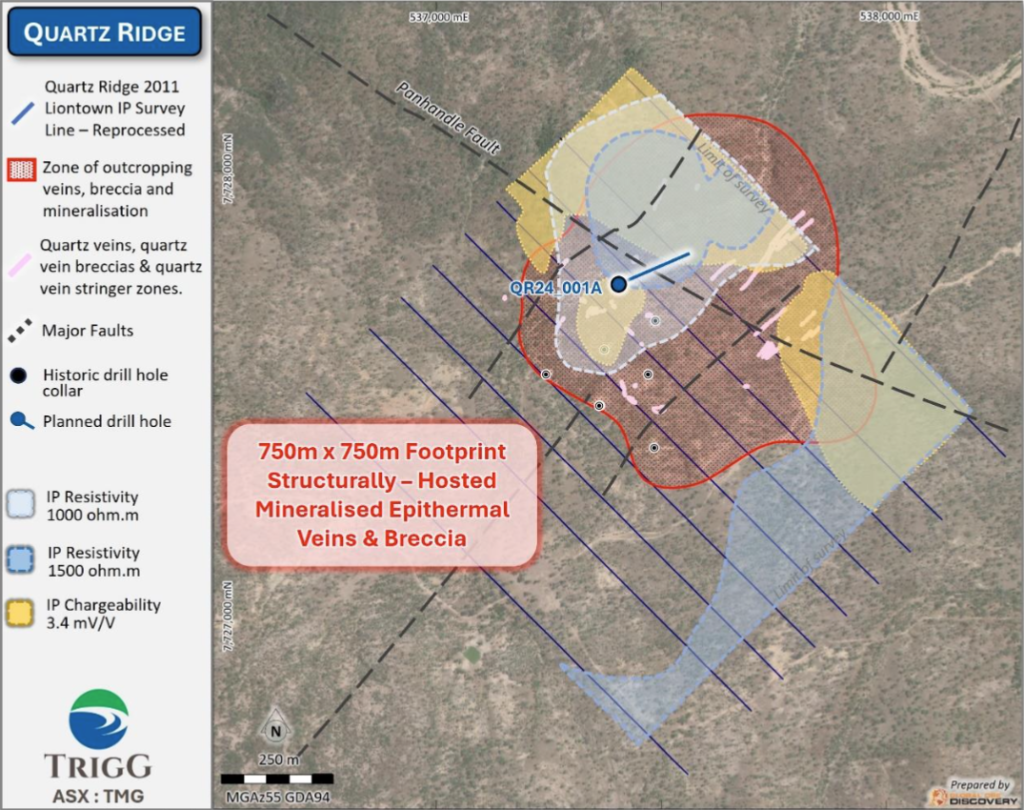

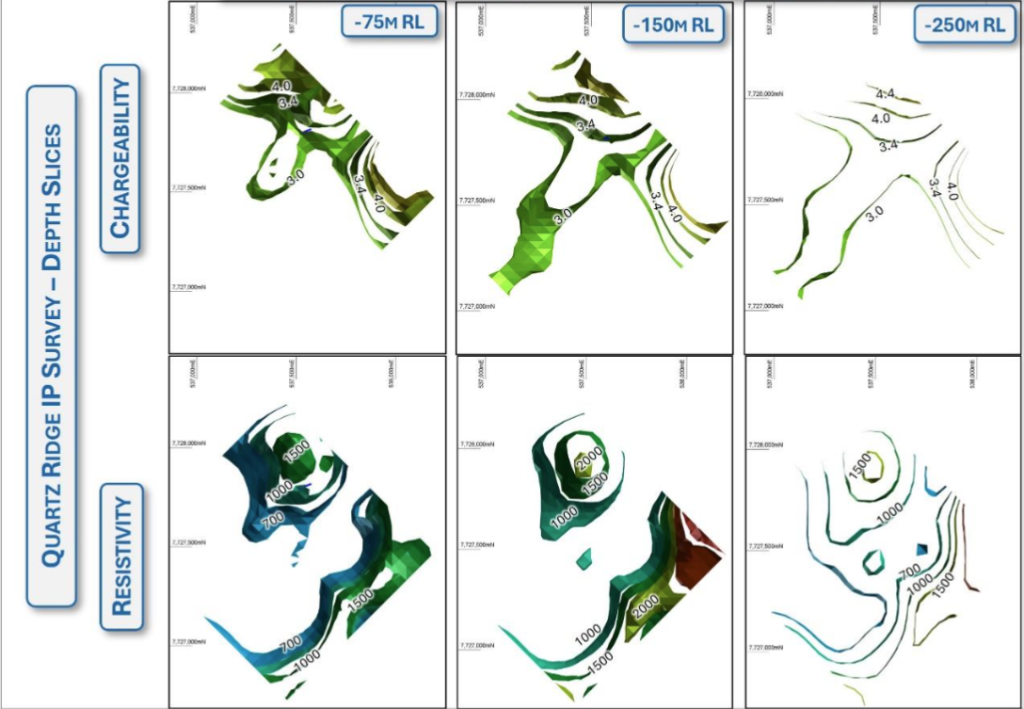

Quartz Ridge

- Epithermal vein structures hosted within felsic to intermediate volcanic rocks

- Limited historical drilling undertaken by Newmont (2007) and Ramelius Resources (2012)

- Historical drilling focused on outcropping NE striking epithermal quartz veins

- Best rock chip assay of 9.54g/t Au along NE trending veins

- Whilst historic drilling intersected restricted zones of quartz veining, no significant gold intercepts >1g/t Au were reported.

- Previous work includes 11.7 km line IP survey undertaken by Liontown Resources in 2011. Trigg compiled and re-processed this data, identifying two notable anomalies

- Single drill hole in 2h2024 to test the identified IP anomaly for significant volume of mineralised epithermal quartz

Major discoveries in the prolific Drummond Basin

| Discovery | Resource |

|---|---|

| Pajingo Gold mine | Produced more than 3.4moz since 1996. Currently producing over 80,000oz per annum. |

| Mt Leyshon Gold mine | Historic gold mine that produced over 3moz of gold and 2.3moz of silver. |

| Ravenswood Gold mine | The Ravenswood gold mine contains reserve resources of 7moz Gold and has processed 3.5moz of gold since it began operations in the late 1980s. |

| Charters Towers | The Charter Towers gold mine project contains an inferred resource of 14moz @ 14g/t (cut off 3.0g/t) and probable ore reserve of 620koz @ 7.7g/t (cut off 4.0 g/t). |

| Mt Carlton | Mt Carlton has produced 700koz of gold plus copper and silver credits since 2013 and boasts an overall endowment of 2moz. |

The Drummond basin and surrounding projects consists of eleven granted exploration permits. (EPM 28419, EPM 27752, EPM 25660, EPM 18090, EPM 25660, EPM 27501, EPM 26154, EPM 25660, EPM 26155, EPM 27752, EPM 27991, EPM 27834, EPM 28419)

Major Discoveries In The Prolific Drummond Basin

| Discovery | Resource |

|---|---|

| Pajingo Gold mine (Yuxin Holdings) | Produced more than 3.4moz since 1996. Currently producing over 80,000oz per annum |

| Mt Leyshon Gold mine | Historic gold mine that produced over 3moz of gold a 2.3moz of silver |

| Ravenswood Gold mine (EMR/GEAR) | The Ravenswood gold mine contains reserve resources of 7moz Gold and has processed 3.5moz of gold since it began operations in the late 1980s. |

| Charters Towers (CitiGOLD) | The Charter Towers gold mine project contains an inferred resource of 14moz @ 14g/t (cut off 3.0g/t) and probable ore reserve of 620koz @ 7.7g/t (cut off 4.0 g/t). |

| Mt Carlton | Mt Carlton has produced 700koz of gold plus copper and silver credits since 2013 and boasts an overall endowment of 2moz. |

The Drummond basin and surrounding projects consists of eleven granted exploration permits. (EPM 28419, EPM 27752, EPM 25660, EPM 18090, EPM 25660, EPM 27501, EPM 26154, EPM 25660, EPM 26155, EPM 27752, EPM 27991, EPM 27834, EPM 28419)

Antimony Potential In The Drummond Basin

Epithermal style gold and polymetallic deposits can contain significant amounts of Stibnite, which is the primary ore mineral of Antimony (Sb).

In particular, low-sulfidation epithermal systems are more likely to contain Stibnite, as it forms within environments with relatively low temperatures and pressures, permitting a range of sulfide minerals like Stibnite to precipitate along with Gold, Silver and other associated minerals.

Stibnite and Antimony are often found in association with Quartz veins within Epithermal Gold deposits.

The Drummond Basin project (EPM 18090), previously held by Adelaide Resources (Andromeda Metals), revealed elevated antimony (Sb) anomalies through surface rock chip sampling at the South West Limey, Two Mile Jaspers, Breccia Hill, and Limey Dam targets.

The recently acquired Bosworth (EPM 28419) and West Ravenswood (EPM 27752) projects show potential for hosting economically significant orogenic and intrusion-related mineral systems. These systems may contain gold, copper, molybdenum, base metals, and possibly low-temperature epizonal gold-antimony deposits.

The company announced on 16th September 2024 that drilling at the South West Limey target in the Drummond Basin had commenced. The reverse circulation and diamond drilling campaign will consist of six holes, totalling 1,280 metres of RC and 370 metres of DD targeting the SW Limey, Breccia Hill and Quartz Ridge prospects.

The much anticipated drilling program has commenced at the SW Limey target

Trigg Minerals Executive Chair Timothy Morrison stated

❝ Identifying a preserved epithermal system at SW Limey with an IP signature resembling the renowned Pajingo gold deposit is compelling and validates our team’s thorough approach at Drummond.❞

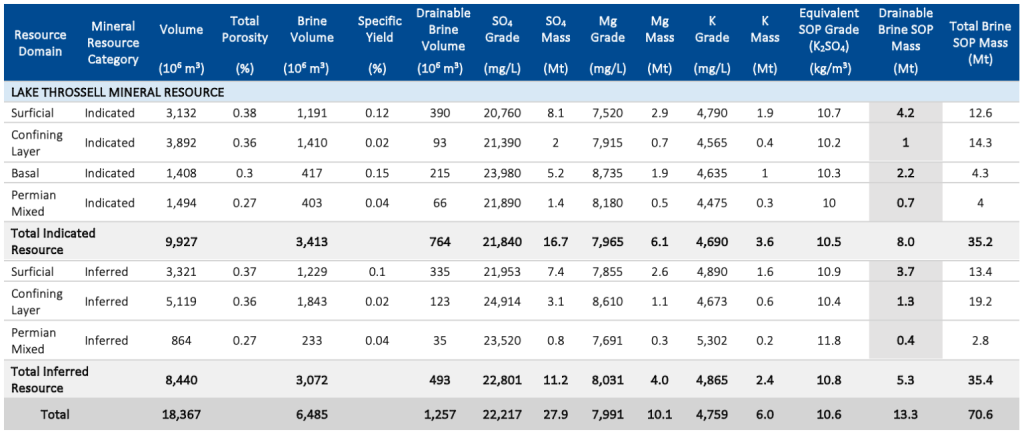

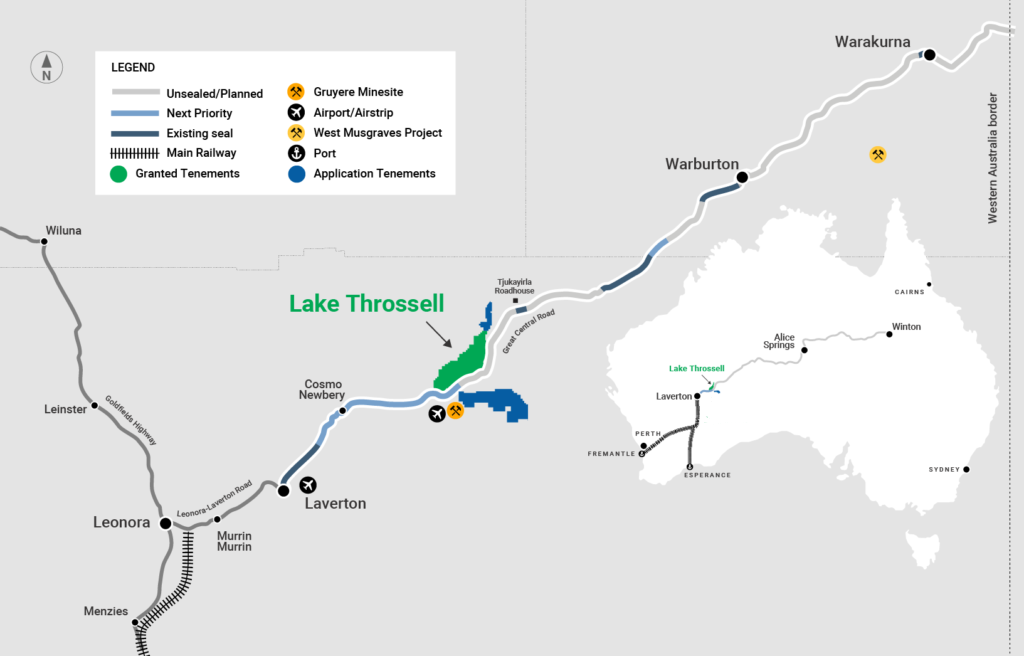

Lake Throssell, Sulphate of Potash (SOP) project

Trigg holds 100% interest in three sulphate of potash (SOP) projects located approximately 170km east of the mining town of Laverton. The total project area is 1,085km². The Project contains a total drainable Mineral Resource Estimate of 14.4Mt of SOP, plus an additional Exploration Target.

Sulphate of potash (SOP) is primarily used as a fertiliser in agriculture due to its high potassium content and the absence of chloride, which can be harmful to some plants. Its key role in optimising crop health and growth makes it a critical input for the agricultural sector, particularly for high-value crops such as fruits, nuts, tobacco, tea and coffee.

Conclusion

Trigg provides exposure to high-potential Antimony and Gold prospects located in New South Wales’ Taylors Arm Antimony Province, as well as the Drummond Basin region of east-central Queensland, both of which could be transformative for the company.

There is potential to delineate an economic resource from some of the historic Antimony mines acquired, which have not been subject to modern exploration methodology. The mines are in close proximity and accessible provided landholder access is negotiated where necessary.

Modern exploration methods offer significant potential to unlock new discoveries at historic mines. By utilising techniques such as geophysical surveys like Induced Polarisation (IP) and magnetics, hidden sulfide mineralisation such as Stibnite, can be identified. Geochemical sampling, including soil and stream sediment analysis, can identify trace Antimony and pathfinder elements, in areas with limited surface exposure.

The Spartan project which is adjacent to the Hillgrove Gold-Antimony mine provides for an interesting prospect that may contain the same mineralised intrusions as the Hillgrove mine.