by admin

Share

by admin

Share

On 30/09/2024, Trigg Minerals announced they had acquired the Wild Cattle Creek Antimony deposit, the highest grade undeveloped Antimony deposit in Australia.

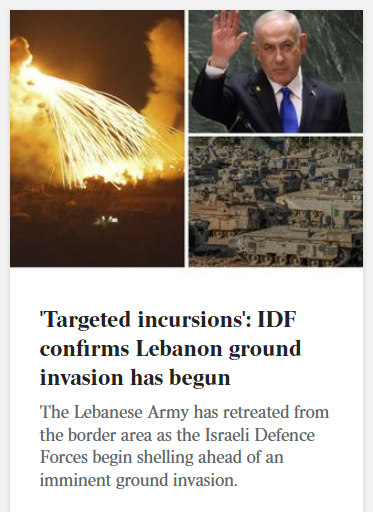

The Israeli Defence Forces (IDF) have announced today (01/10/2024) that they have launched a ground invasion of Southern Lebanon, which is further escalation of the existing conflict in Gaza. The other global conflict raging undeterred is the Russia-Ukraine war. Both of these conflicts create added pressures on the Antimony supply chain, which is critical for military applications.

Gaza. The other global conflict raging undeterred is the Russia-Ukraine war. Both of these conflicts create added pressures on the Antimony supply chain, which is critical for military applications.

In addition to these conflicts surging demand for Antimony, the West’s supply of Antimony has been curtailed with China (48% of global production) banning exports of Antimony ore and products.

Military Antimony applications include:

- Hardeners for lead in ammunition

- Armour-piercing ammunition

- Tracer ammunition

- Nuclear weapons production

- Strengthening alloys used in military equipment and vehicles

- Infrared sensors and night-vision technology

- Precision optics

- Electronic components in military-grade electronics and communication systems

- Laser sighting Flares

- Military clothing

In light of the increasing demand and dwindling supply, Western governments must aggressively delineate Stibnite (Antimony) resources and assist explorers with progressing discoveries into production. One recent example of government support for Antimony projects, is the United States federal government contributing US$75m in grants to Perpetua resources and a loan offer of US $1.8bn.

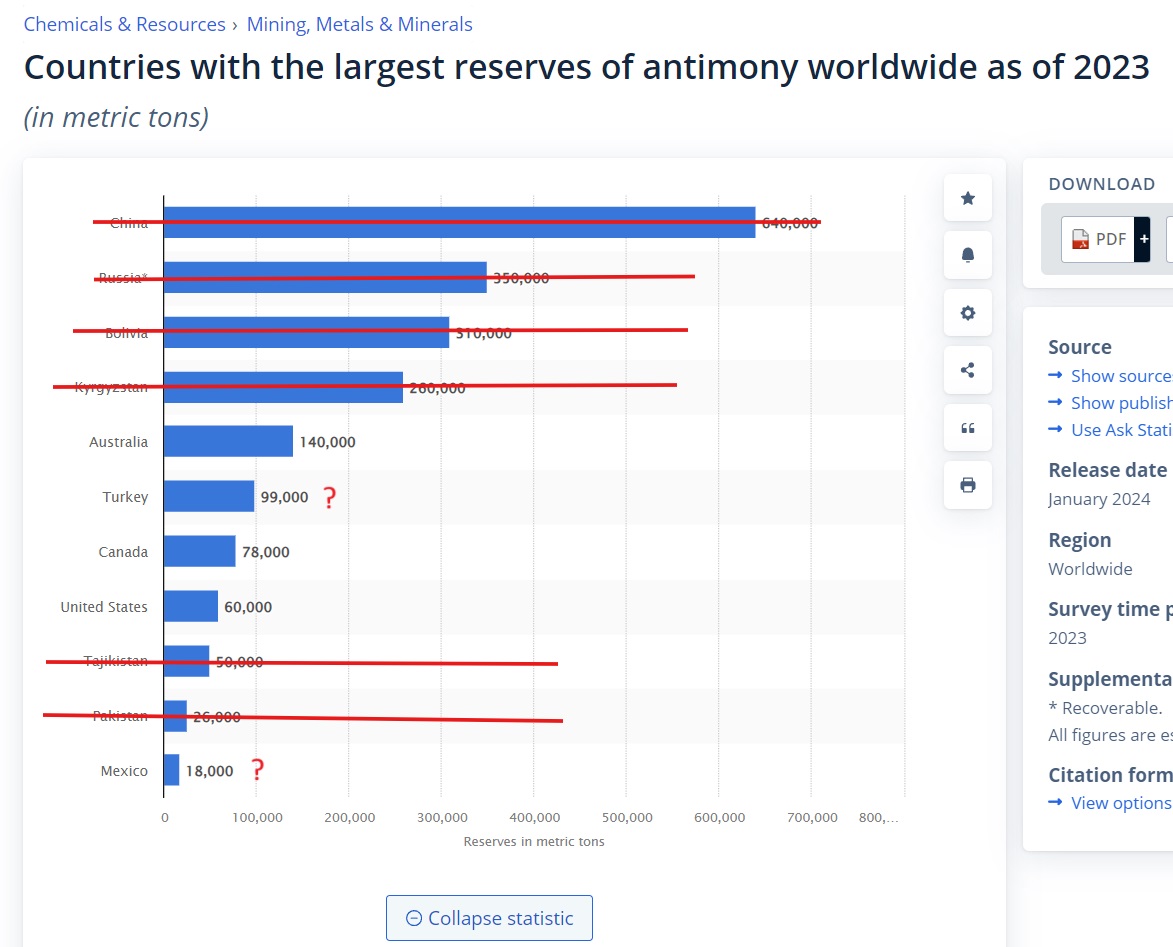

In 2023, the total reserves for Western and Western aligned nations is 395,000t Sb or 278,000t Sb excluding Türkiye and Mexico. Türkiye has made an application to join Russia/China led BRICS organisation despite being a member of NATO (North Atlantic Treaty Organization) and Mexico is sympathetic to Russia.

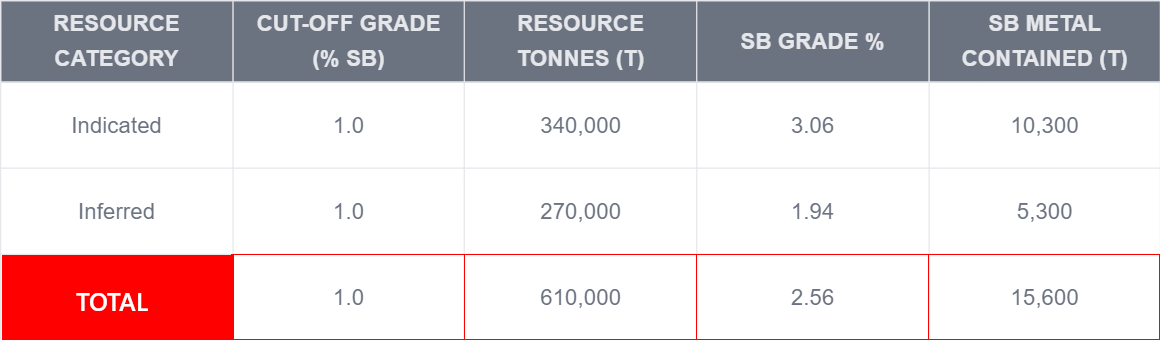

The current mineral resource statement at Wild Cattle Creek of 15,610t contained Stibnite represents 4% of 395,000t or 5.6% of 278,000t, making the project of significant proportions in the Western sphere.

Mineral resource statement at Wild Cattle Creek deposit. SRK Consulting, 2013

It’s crucial to recognise that, to date, there have been no large-scale Stibnite discoveries in the West. High-tonnage deposits with quality grades are found exclusively in China.

One notable example of a high-tonnage discovery is China’s Xikuangshan Antimony mine, which holds 2 million tonnes of Stibnite at a 4% grade (2017). Xikuangshan has been a prolific producer, yielding 53 million tonnes up to 1980. No deposit or mine in the West comes close to matching these figures.

In the Western sphere, there are very few Stibnite deposits that meet NI 43-101 or JORC compliance standards.

In Canada, the Chinese-owned Beaver Brook Antimony Mine in Newfoundland was indefinitely suspended and placed under care and maintenance in 2023 due to ore depletion. When mining operations resumed in 2008, Beaver Brook had a resource of 1.06 million tonnes at 5.15% Sb, containing 54,590 tonnes of Stibnite.

The other prominent Western based projects is the Perpetua Resources Stibnite Gold project in Idaho. The project while high tonnage is considerably low grade, containing 104.6mt @ 0.06% for 67,131 tonnes of Stibnite contained. In the first four years of operation, it is projected to only contribute 8346t of Stibnite. The project is not expected to be in production till 2028.

In Australia, the Hillgrove Mine, with 7.26 million tonnes at 1.3% Sb, equating to 93,000 tonnes of contained stibnite, and the Costerfield Mine, holding 965,000 tonnes at 3.0% Sb, containing 28,800 tonnes of stibnite.

Trigg Minerals’ Wild Cattle Creek deposit holds strategic significance given the dwindling supply and the scarcity of Western-aligned Stibnite deposits.

There is significant potential to double the existing resource through an aggressive drilling program targeting mineralisation down plunge to the west and along trend of the Bielsdown fault.

Read our report on Trigg Minerals acquisition of the Wild Cattle Creek Antimony deposit.

Disclaimer: Bullseye Analytics (the company) or associated entities own 150,000,000 TMGOD options as of the publication date of this article.