Date of publication: 19/05/2025

Our initial report on Triggs Minerals can be read here: ASX: TMG – Trigg Minerals

Our report on Triggs Minerals acquiring the Wild Cattle Creek antimony deposit can be read here: Trigg Minerals Acquires Advanced Antimony Deposit

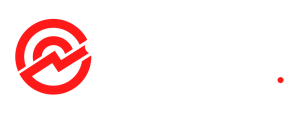

Trigg Acquires Largest & Highest Grade

Antimony Deposit in the USA

100,330 tons of contained Antimony @ 0.79% Sb

“Antimony Canyon Project”

Utah, USA

Trigg Minerals is positioning itself to address global antimony supply concerns through the strategic acquisition of antimony deposits and highly prospective tenements.

The acquisition of the Antimony Canyon project, located in Utah, USA, represents a significant strategic opportunity to supply the United States with a critical mineral currently facing significant global supply constraints. These constraints have intensified following the deterioration of US-China relations and China’s export ban on antimony and antimony ore, implemented on 15 September 2024.

✔ 100,330 Tons Antimony

Resource

The U.S. Bureau of Mines (1949) reported a historical resource estimate of 12.7 million metric tons grading 0.79% Sb for 100,300 tons of contained antimony. The Utah Geological and Mineral Survey (1975) revised the historical estimate to 14 million metric tons at 0.75% antimony, containing 105,000 tons of antimony. The resource estimates are not JORC compliant.

✔ Mining Friendly Jurisdiction

Of Utah

Utah is widely recognised as a mining-friendly jurisdiction, offering a stable regulatory environment, clear permitting processes, and strong government support for resource development. With a rich history in mining and abundant mineral resources, including copper, gold, silver, and lithium. The state provides a favourable climate for exploration and development.

✔ Federal Gov Funding

Potential

The U.S. government is actively supporting domestic critical mineral projects to reduce reliance on foreign sources, particularly for antimony, a key component in defence and energy technologies. Perpetua Resources’ Stibnite Gold Project in Idaho has received US$75 million from the Department of Defense to advance construction readiness and permitting.

✔ Antimony Price Continues to Surge

As Chinese antimony supply declines due to resource depletion, global availability tightens significantly. This reduction, coupled with rising domestic demand, is straining international supply. Western countries, lacking domestic production, are increasingly competing for a shrinking pool of antimony.

✔ No Local Antimony Supply

The United States currently has no active domestic antimony mines, making it entirely reliant on foreign sources, primarily Tajikistan. Antimony is essential for national defence, flame retardants, and batteries, yet the lack of a local supply creates a strategic vulnerability.

✔ Resource Expansion Potential

The historical resource is based on a limited number of mines within the camp. Comprehensive exploration using modern methods of all mineralised trends and legacy workings present an opportunity to substantially increase the resource.

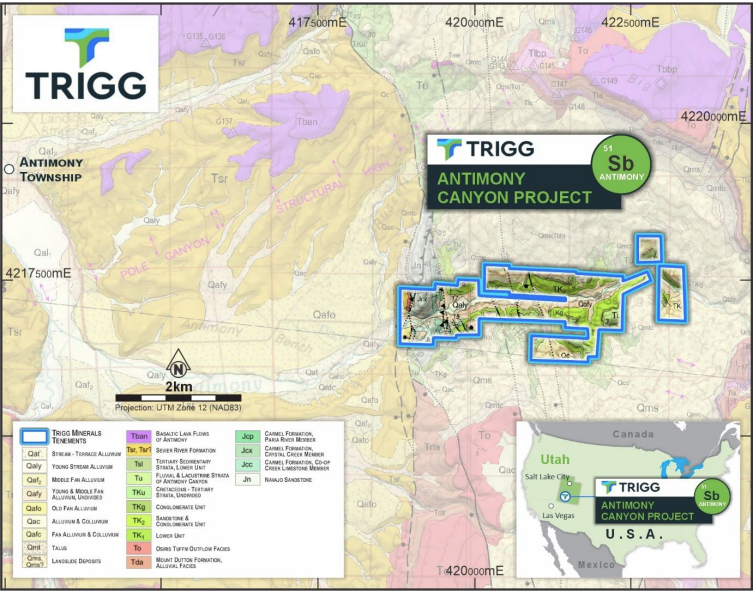

Location

The Antimony Canyon Project is situated in Garfield County, Utah, approximately 11 kilometres east of the town of Antimony. The canyon encompassing the project area is commonly known as either Coyote Creek Canyon or Antimony Canyon.

The project lies approximately 6 kilometres from the main arterial route, State Highway 22.

Access to the project is straightforward via State Highway 22, turning onto Bench Road / Antimony Canyon Road, both of which are sealed. From there, the project is accessed via an unpaved road extending from Bench Road / Antimony Canyon Road.

The site’s proximity to a main arterial road provides outstanding access and supports efficient project development.

The project is located approximately 350 kilometres south of Salt Lake City, Utah’s largest city, and is accessible via state highways.

Utah is widely regarded as a mining-friendly jurisdiction, thanks to its clear regulatory framework, pro-business government policies, and rich natural resource base.

The state boasts a long history of mining, stretching back to the 1800s, and today remains one of the most productive mining regions in the United States. Utah offers streamlined permitting processes, stable legal and political conditions, and a skilled workforce — all of which make it attractive for mining investment.

Additionally, its well-developed infrastructure and access to rail and road support efficient transport of mined materials to both domestic and international markets.

Rio Tinto’s Bingham Canyon Mine’s proven and probable reserves are estimated at 782 million tonnes of ore with a copper grade of 0.37%, equating to approximately 2.591 million tonnes of recoverable copper.

Major Mines in Utah:

- Bingham Canyon Mine (Kennecott Copper Mine) – One of the largest open-pit copper mines in the world; also produces gold, silver, and molybdenum.

- Spor Mountain Mine – Known for being the world’s largest producer of Beryllium, critical for aerospace and defence industries.

- Lisbon Valley Mine – Open-pit copper mine with gold and silver by-products.

- Great Salt Lake Operations (Ogden) – Largest U.S. producer of Sulfate of Potash.

History

Albion Antimony mine, located in Coyote Creek mining district

Antimony was discovered in Antimony Canyon during the 1880s by Native Americans, who mistakenly identified stibnite as lead and initially attempted to use it as such. Since its discovery, the deposits have been worked sporadically due to weak antimony prices.

Early mining efforts focused on collecting large quantities of loose, stibnite-enriched rock found on the surface. Once these easily accessible sources were exhausted, attention shifted to extracting high-grade pods exposed along the cliff faces.

In 1907, a local mill was established to process antimony ore from the surrounding workings. During the First World War, antimony mining in the region experienced a resurgence, with two local mines supplying ore to ammunition plants in support of the war effort.

A considerable quantity of antimony was mined in the area, leading local residents to name the nearby town ‘Antimony’ in 1920, in recognition of the metal’s abundance in the surrounding canyons.

With the onset of the Second World War, the US Bureau of Mines conducted studies in Antimony Canyon between November 1941 and February 1942, as part of efforts to secure domestic antimony supplies for the armaments industry.

A 1949 report commissioned by the Bureau noted that numerous small deposits and historical workings were scattered across an area approximately 3 miles (4.82 kilometres) east–west and 2 miles (3.21 kilometres) north–south, primarily within cliffs composed of unconsolidated sandstone and shale. The mineralisation consists of veinlets, lenses, and irregular blebs of stibnite.

Deposit

Project location and claim boundaries over regional geology. The mineralised host unit is shown in lime green (TK2), with additional mineralisation occurring within the extensive talus slopes below the prominent cliffs.

The Antimony Canyon Project hosts a historical, non-JORC compliant resource estimate of 12.7 million metric tons at a grade of 0.79% Sb, containing approximately 100,330 tons of antimony. This estimate was prepared by the U.S. Bureau of Mines in 1949.

In 1975, the Utah Geological and Mineral Survey revised the historical resource estimate using channel samples taken near the old mines. The new estimate indicated a resource of 14 million tons at a grade of 0.75% Sb, corresponding to approximately 105,000 tons of contained antimony metal.

The deposits at Antimony Canyon generally trend east-west. The cliff walls on either side rise steeply, reaching heights of up to 240 metres above the creek bed.

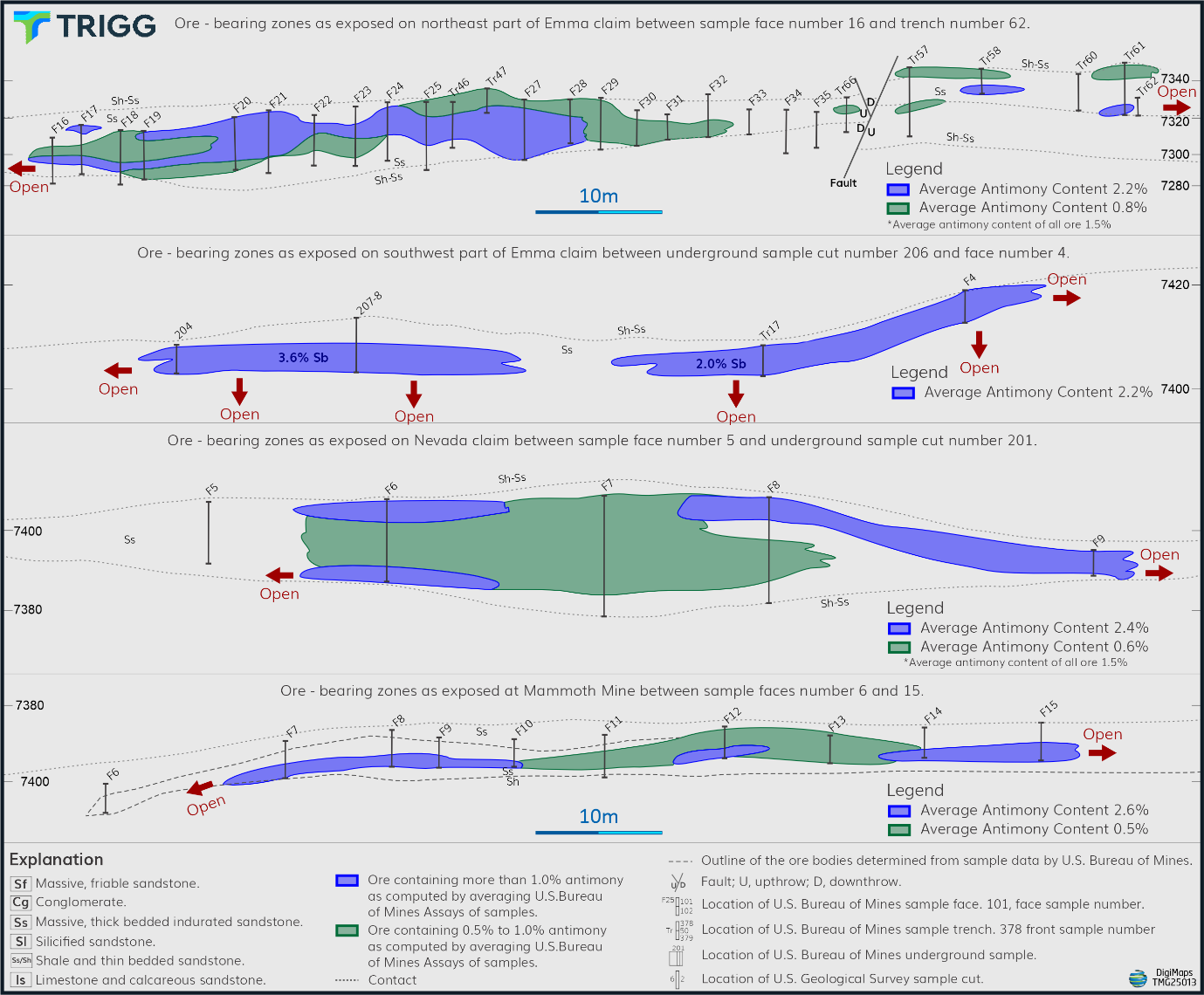

Ore-bearing zones exposed in cliff faces at the principal historical mines in Coyote Canyon, Garfield County, Utah (modified from Utah Geological and Mineral Survey, 1975).

Sb (antimony) mineralisation occurs within the Flagstaff Formation, dating to the late Paleocene. The high-grade Sb mineralisation is found as horizontal, lenticular orebodies and pods situated above the lowermost sandstone/shale unit, within the overlying, more massive sandstone of the Flagstaff Formation.

The ore zones vary in thickness from 5 feet (1.52 metres) to 35 feet (10.66 metres). The primary ore mineral is stibnite (Sb₂S₃), accompanied by minor amounts of valentinite (Sb₂O₃).

An area of interest for further exploration includes both the primary ore and the debris mantle, or ‘talus slope’, located below the cliffs that were the main focus of the 1949 fieldwork and the subsequent 1975 revised historical resource estimate

The Antimony Canyon project consists of numerous historically producing high-grade antimony mines, including but not limited to:

- Emma mine averaging 1.5% Sb with considerable zones averaging 2.2% Sb

- Mammoth mine averaging 1.5% Sb with considerable zones averaging 2.4% Sb

- Nevada mine averaging 2.2% Sb with considerable zones averaging 3.6% Sb

The original historical resource was limited to sampling across select portions of the Emma, Albion, Nevada, Stebinite, Stella and Mammoth claims. The project includes several additional former producers, such as Gem, Pluto, Winner, Baltimore-Maryland and Fault-Slice mines that have yet to be systemically evaluated.

View of Antimony Canyon Project site

Given the scale of the historical workings and the demonstrated mineralisation across multiple sites, there is clear potential to define a materially larger resource.

Trigg Minerals will undertake a comprehensive exploration program at Antimony Canyon, with the immediate priority being to validate and upgrade the historical resource to a JORC-compliant mineral resource estimate (MRE).

This work will be underpinned with a detailed geological mapping, geochemical sampling, modern geophysical surveys and drilling designed to determine the full extent of the mineralisation across the entire project area.

US. Government Funding

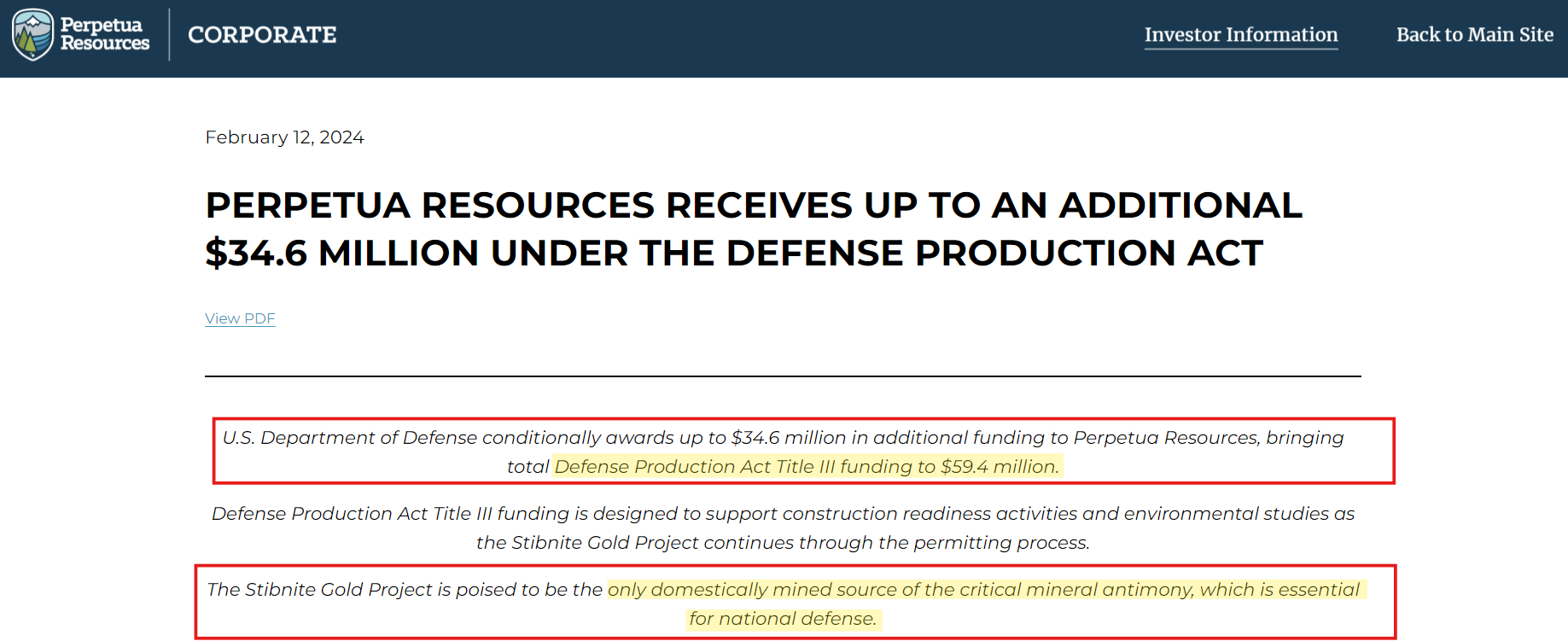

The Antimony Canyon Project will provide Trigg Minerals with a pathway to pursue US government funding under the Defense Production Act and other similar initiatives aimed at supporting critical minerals production in the United States, driven by national security priorities.

The Antimony Canyon Project will provide Trigg Minerals with a pathway to pursue US government funding under the Defense Production Act and other similar initiatives aimed at supporting critical minerals production in the United States, driven by national security priorities.

One example of a recipient of federal government funding is Perpetua Resources (PPTA.O), which is advancing its Idaho-based Stibnite Gold Project. This project contains 104 million tonnes with Proven and Probable Mineral Reserves of 67,131 tonnes of stibnite at a grade of 0.06%

Perpetua Resources has secured significant financial backing from U.S. government entities to advance its Stibnite Gold Project in Idaho, a venture aimed at re-establishing domestic production of antimony—a critical mineral for national defence and clean energy applications.

U.S. Department of Defense (DoD) Grants

Perpetua Resources has been awarded multiple grants under the Defense Production Act (DPA) Title III program, totalling nearly $75 million:

- Initial DPA Title III Award: In December 2022, the DoD conditionally awarded up to $24.8 million to Perpetua to support the development of a domestic antimony supply chain.

- Additional DPA Title III Funding: In February 2024, Perpetua received an additional conditional award of up to $34.6 million, bringing the total DPA Title III funding to $59.4 million.

US $1.8bn loan offer for Perpetua’s Stibnite-Gold project in Idaho

- Defence Logistics Agency (DLA) Grants: In September 2022, the Defence Logistics Agency awarded Perpetua two grants to study the feasibility of producing military-grade antimony trisulfide from the Stibnite site.

U.S. Export-Import Bank (EXIM) Financing

In April 2024, Perpetua received a Letter of Interest from the U.S. Export-Import Bank for potential debt financing of up to $1.8 billion. This financing, under EXIM’s “Make More in America” and “China and Transformational Exports Program” initiatives, aims to support the development and construction of the Stibnite Gold Project.

As of March 2025, Perpetua plans to submit a formal loan application to EXIM in the second quarter of the year.

Antimony Outlook

Supply Struggles Continue Despite Tariff Pause

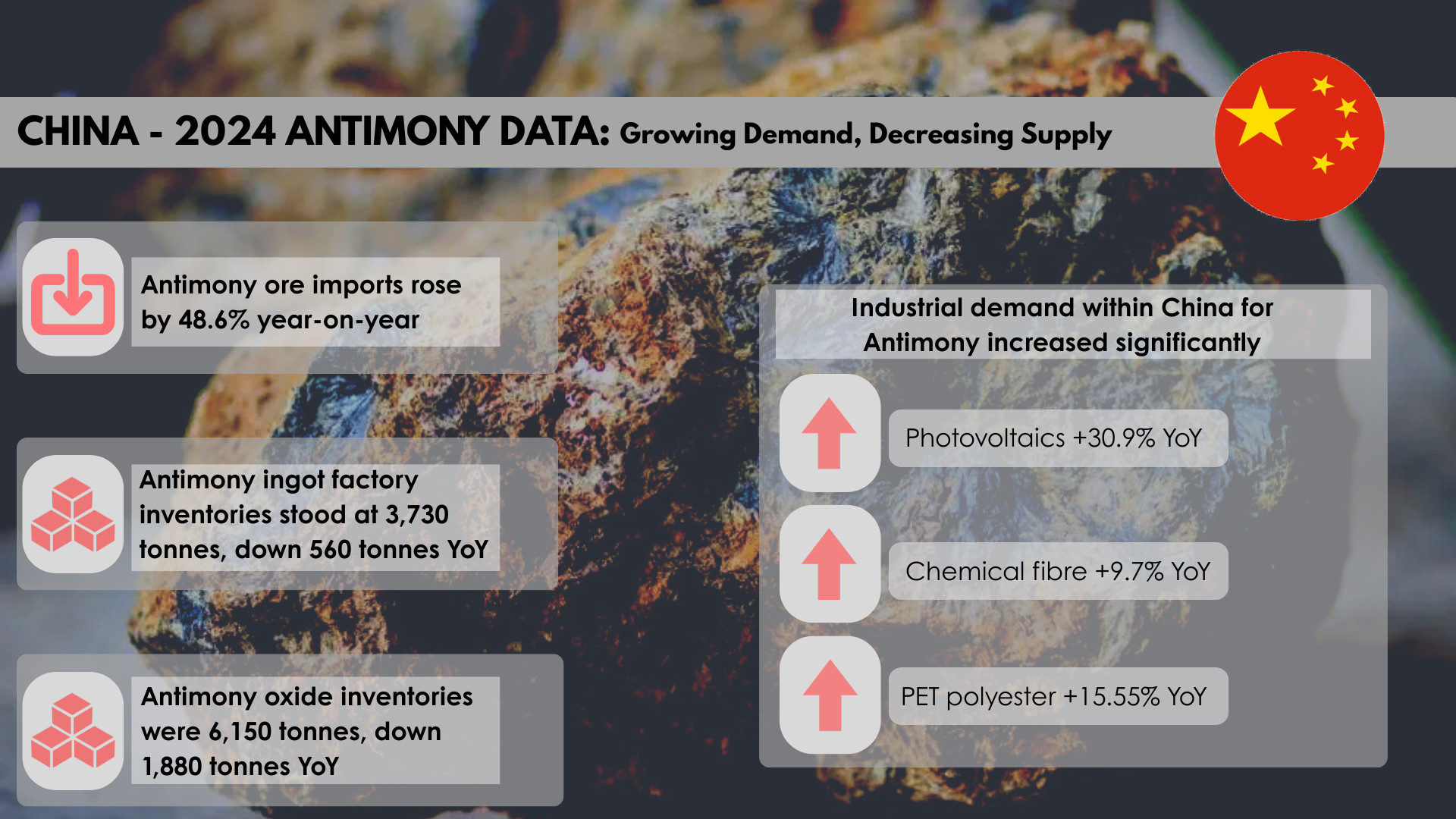

The 90-day suspension on reciprocal tariffs, announced on Monday 12 May 2025, has had no material impact on the antimony market or its long-term outlook.

Under the agreement, the United States has agreed to reduce its tariff on Chinese imports to 30%, while China has lowered its tariff on US goods to 10%. However, the pause is merely a window for negotiations to reach a longer-term trade resolution. Crucially, critical minerals including antimony remain excluded from this agreement.

China first imposed an antimony export ban on 15 September 2024, citing national security concerns. This decision came just weeks ahead of the US presidential election on 5 November 2024, and seven months before President Trump’s widely publicised “Liberation Day” on 2 April 2025, which saw sweeping tariffs imposed on US imports from all countries.

Antimony prices have remained robust, driven by tightening global supply and increasing scarcity. China’s domestic resources are rapidly depleting, with declining head grades and limited new discoveries. As local production diminishes, China is increasingly reliant on overseas suppliers, particularly the Central Asian Republics and Myanmar, though even these sources are proving less dependable.

In March 2025, China imported just 1,483 tonnes of antimony ore concentrate – a drop of 55.8% from the previous month and down 63.9% year-on-year.

The current supply deficit in the antimony market is not primarily the result of China’s export restrictions. Rather, it stems from insufficient domestic reserves and China’s own surging internal demand. Like the rest of the world, China is now competing on the international market to secure antimony imports.

The root cause of today’s supply shortfall lies in a decade of underinvestment in antimony exploration and project development. For much of the last ten years (2013–2023), antimony prices averaged just USD $8,000–$9,000 per tonne – levels that failed to incentivise the kind of exploration and project pipeline necessary to meet future demand.

Summary

Trigg Minerals is now firmly positioned as an emerging major player in the antimony sector, with significant potential to address the growing global antimony shortfall. The recent acquisition of the Antimony Canyon Project, alongside the existing Wild Cattle Creek Project, lifts Trigg’s total contained antimony resource to 130,202 tons.

At current Antimony market prices (A$92,876 per metric tonne), the in-situ value of the combined resource stands at approximately A$12.09 billion. While the Wild Cattle Creek Project is JORC-compliant, with most of the resource being in the Indicated category—the Antimony Canyon Project is not yet compliant and will require updated work to meet JORC standards.

Importantly, the Antimony Canyon Project opens the door for Trigg Minerals to explore funding opportunities with the Pentagon, following a precedent set by Perpetua Resources, which secured US$75 million in grants and US$1.8 billion in loan guarantees. Unlike Perpetua’s Stibnite Gold Project in Idaho, which is primarily a gold project with antimony credits, Antimony Canyon is a primary antimony deposit and boasts a larger resource and significantly higher grade.

Project Comparisons:

-

Perpetua (Stibnite-Gold Project, Idaho): 104Mt for 67,131 tons of Stibnite @ 0.06% Sb

-

Trigg (Antimony Canyon Project, Utah): 12.7Mt for 100,300 tons of Stibnite @ 0.79% Sb

Due to the limited historical exploration across Antimony Canyon and the absence of modern exploration techniques, there is strong potential to expand the resource significantly.

Utah remains a highly supportive jurisdiction for mining, and given the project’s historical mining activity, regulatory approvals are expected to be relatively straightforward.

This acquisition also coincides with the appointment of Andre Booyzen as managing director, one of the world’s leading antimony experts. With over 25 years of experience in operational, senior, and executive roles, including as Vice President of Mandalay Resources, where he had operational oversight of the Costerfield gold-antimony mine in Victoria.