Adelong Gold has executed a binding sale agreement to acquire a 100% interest in high-grade Lauriston Gold project from Great Pacific Gold Corp. (TSXV: GPAC).

An epizonal gold-antimony mineralised project which has the best potential to be the southern extension of the Fosterville Goldfield Belt, outside of Agnico Eagle’s extensive tenements.

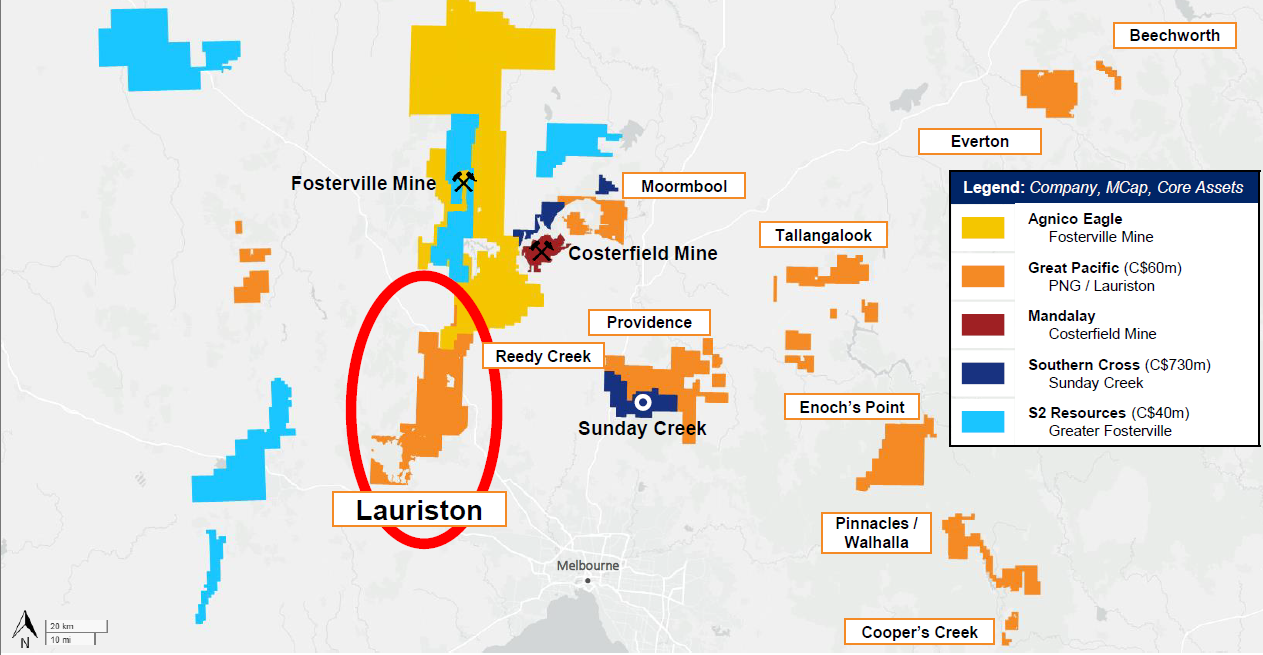

Lauriston Gold Project located within the prolific Bendigo zone

Lauriston tenement contains the south extension of the Whitelaw Fault & Gold Belt which is a key feature of the Bendigo Goldfield (22Moz).

The Lauriston project is located adjacent and along strike to Agnico Eagle’s (market cap US$59.24bn) world-class Fosterville mine and proximal to Costerfield and Sunday Creek within Victoria’s prolific Bendigo zone.

Victoria’s Bendigo zone is known for it’s massive gold production, having yielded over 60 million troy ounces of Gold, making it the largest gold-producing zone in Victoria.

Between 1850 and 1954, the Bendigo zone produced over 700,000kg of Gold.

The Fosterville mine is known as one of the world’s highest grade and lowest cost gold mines.

High-grade results from Lauriston’s comet discovery include:

➤ 8m @ 104 g/t Au (including 2m @ 413 g/t Au ) in hole CRC07

➤ 9m @ 11.6 g/t Au (including 4m @ 25.1 g/t Au) in hole CDH01A

➤ 5.9m @ 15.3 g/t Au (including 4m @ 22.5 g/t Au) in hole CDH10

Post discovery drilling has been limited with only 2600m drilled in 2023-2024, compared to the 76,000m drilled by Southern Cross Gold with their Sunday Creek discovery. The limited drilling provides an exceptional opportunity for Adelong Gold to unlock a high-grade Gold discovery, which may potentially be an analogue to Fosterville.

Managing director Ian Holland returns to the Bendigo Zone

Adelong Gold’s managing director, Ian Holland, is an experienced mining executive with a strong track record of operations management and value creation, who has successfully transitioned exploration projects to production.

The high-grade Fosterville Gold mine where Adelong Gold managing director Ian Holland was employed for 13 years and 3 months

Ian boasts 25 years experience in the mining industry and was previously employed at Kirkland Lake Gold as vice president of Australian Operations responsible for the Fosterville Gold mine. For the 10 years prior, Ian was employed at the Fosterville Gold mine in various positions from GM operations to production, technical and geology manager.

At Fosterville, Ian was a key manager driving the growth of low-cost high-margin production, which ultimately grew the market capitalisation from C$1.5b to C$15b over a 4 year period.

The acquisition of the high-grade Lauriston project, directly adjacent to the Fosterville tenure, marks a return for Ian to a region and geological setting he knows all too well.

The Fosterville Gold Mine, located about 20 kilometres east of Bendigo in Victoria, is the state’s largest gold producer. Since beginning operations in 2005, the mine has produced over 4.4 million ounces of gold and is renowned for its high-grade, low-cost underground mining.

Fosterville has earned a global reputation for its exceptionally high-grade gold production. Notably, in 2020, the mine achieved an average production grade of 33.9 grams per tonne (g/t), yielding over 640,000 ounces of gold. In 2021, production was 509,000 ounces at an average grade of 23.7 g/t. During the first quarter of 2022, the mine produced 126,707 ounces of gold with an impressive average head grade of 28.13 g/t.

The discovery of the ultra-high-grade Swan Zone in 2016 significantly contributed to these elevated grades, with reserves in this zone averaging 31.56 g/t.

Overall, Fosterville’s average production grades have consistently surpassed 20 g/t in recent years, positioning it among the highest-grade gold mines globally.

Ian’s knowledge of the local geology will be of exceptional value to Adelong Gold in the pursuit of potentially discovering an analogue to Fosterville and delineating a high-grade resource.

Adelong Gold’s Managing Director, Ian Holland, commented:

“Securing the Lauriston Gold Project is a significant step forward for Adelong Gold. Lauriston’s high-grade Comet discovery, along with its regional prospectivity adjacent to Fosterville, provides a rare and exciting opportunity for near-term value creation through exploration. This acquisition strengthens our presence in Victoria, and we look forward to rapidly advancing exploration activities across the project.”

Geology

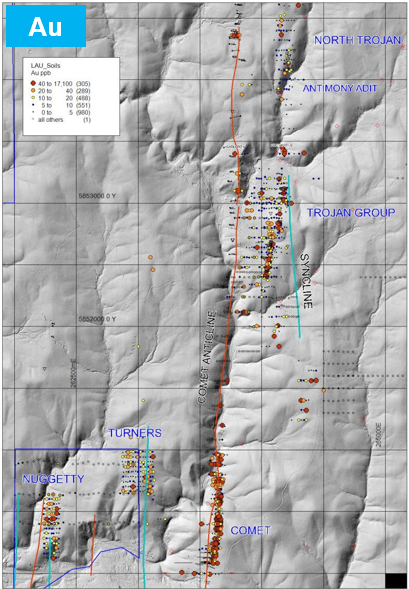

Gold soil anomalies extending along a +4.5km trend across Comet and Trojan prospects

The Lauriston Gold Project comprises a 28,700-hectare landholding within Victoria’s highly productive Bendigo Zone, immediately adjacent to Agnico Eagle’s Fosterville Mine. The project area is easily accessible by established roads.

Early-stage exploration: Small-scale open pit and underground workings are scattered throughout the license area.

Lauriston is hosted within the same Ordovician sedimentary rocks of the Selwyn Block as Fosterville and shares key

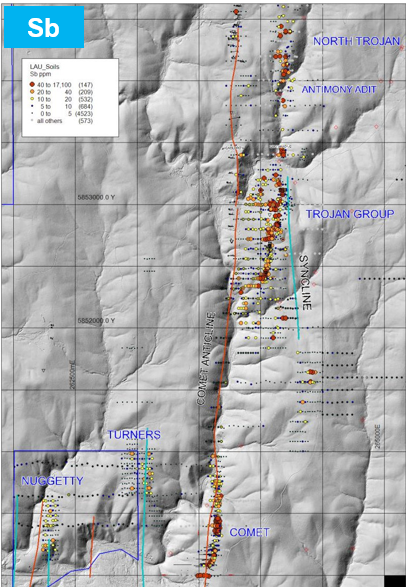

Antimony soil anomalies extending a +4.5km trend across Comet and Trojan prospects

structural, geological, and mineralisation features.

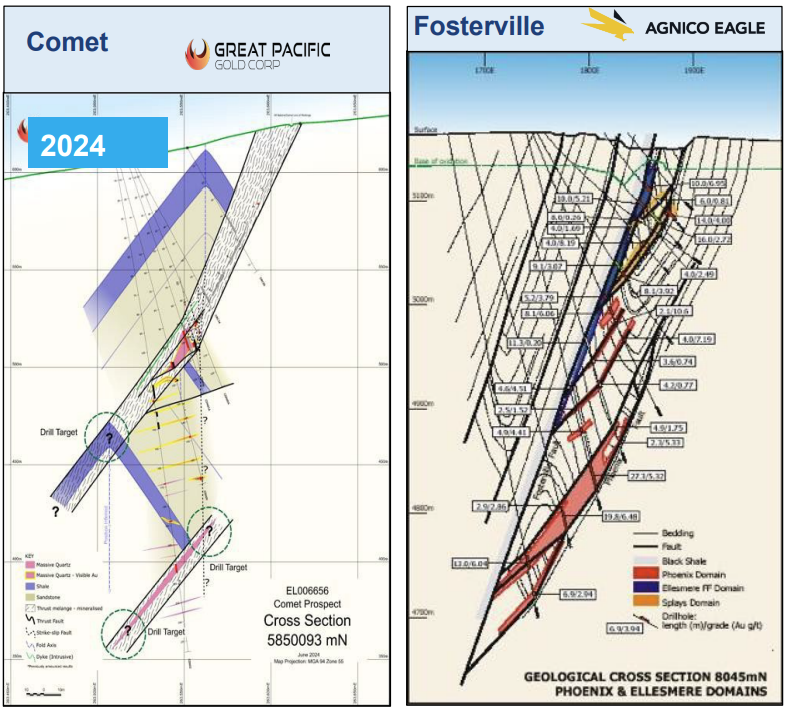

Gold mineralisation at Lauriston is characterised by epizonal gold-antimony (Au-As-Sb) systems, deposited under shallow crustal conditions at temperatures around 200°C ± 50°C, similar to Fosterville’s Swan Zone.

The Lauriston Project lies within the Fosterville Sub-Domain, west of the Heathcote–Mount William Fault Zone, and is interpreted to have formed during the same regional Bindian and Tabberabberan orogenies that controlled gold deposition at Fosterville.

Recent detailed soil geochemistry has outlined a >4.5km long gold-antimony trend linking the Comet and Trojan prospects, suggesting district-scale mineralisation potential similar to that seen at Fosterville.

Historical mining at Lauriston produced approximately 233,000 ounces at an exceptional average grade of 20.7 g/t Au from shallow depths, highlighting the fertility of the system.

Despite its exceptional address, Lauriston has seen limited modern exploration, providing a significant opportunity to unlock value through systematic drilling.

➤ Comprises one consolidated land package encompassing the southern extension of structures associated with the Fosterville gold mine.

➤ Preliminary drilling at Comet has intersected epizonal-style Au-Sb mineralization over various widths and grades (e.g. 8m @ 105 g/t Au).

➤ Epizonal-style Au-Sb mineralisation at Comet is associated with structural splays from a steeply west dipping fault within folded metasedimentary rocks. This is a similar structural interpretation to that applied at Fosterville.

➤ Soil geochemistry suggests Au-Sb mineralization extends through the Trojan project area. Combined, the Comet-Trojan geochemical anomaly extends for 4.5km.

Vertical cross-section comparisons showing similar stacked mineralisation geometries between Comet and Fosterville.

Transaction terms

Pursuant to the Definitive Agreement, the vendor GPAC will receive an initial A$500,000 cash by May 31, 2025. Following the closing of the transaction, Adelong will issue the Company A$750,000 worth of shares at a deemed issue price of A$0.005/share. The shares will be free-trading upon issuance.

The additional A$2,000,000 cash payments will be paid in the following tranches: A$1,000,000 within six months of closing, A$500,000 within twelve months of closing and A$500,000 within eighteen months of closing. In addition, a further A$750,000 of free trading Adelong shares will be issued to GPAC within twelve months of closing. GPAC will also receive a contingent payment of A$2,000,000 within 30 days of the first gold being poured at the Lauriston Project and will retain an uncapped 2% net smelter return royalty on the Lauriston Project.

DATE: 08/05/25

TICKER: ADG

SOI (UNDILUTED): 1,397,486,198

SHARE PRICE: $0.008

MARKET CAP (UNDILUTED): $11.17M

CASH (APPROX): $628K

EV: $10.542M