Date of publication: 30/09/2024

Our initial report on Triggs Minerals can be read here: ASX: TMG – Trigg Minerals

Achilles Project

The Wild Cattle Creek Antimony mine in North Eastern NSW has been acquired

The mine includes a 2012 JORC compliant mineral resource of 610,000t @ 2.56% Sb for 15,600t contained Sb ━ the highest grade undeveloped antimony deposit in Australia

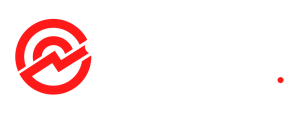

✔ 2012 JORC Compliant Resource

JORC 2012 Compliant mineral resource based on 130 surface drill holes totalling 10,710m and utilising 1% Sb cut off

✔ 15,600 Tonnes of Stibnite (Antimony)

Indicated: 340,000t @ 3.06% Sb for 10,300t

Inferred: 270,000t @ 1.94% Sb for 5,300t

Total: 610,000t @ 2.56% Sb for 15,600t

✔ Opportunity to Increase Resource

Excellent potential for expansion, mineralisation remains open down plunge, at depth and along strike to West

✔ On-site Infrastructure

Project benefits from existing on-site infrastructure such as grid power to the old mine and sealed roads

✔ Mineral Output

Marketable Antimony product produced using conventional flotation technology, consisting of +90% recoveries

✔ Versatility

Open cut extraction of shallow mineralisation followed by underground extraction of deeper resources. Potential Tungsten and Gold by-product credits

Project Background

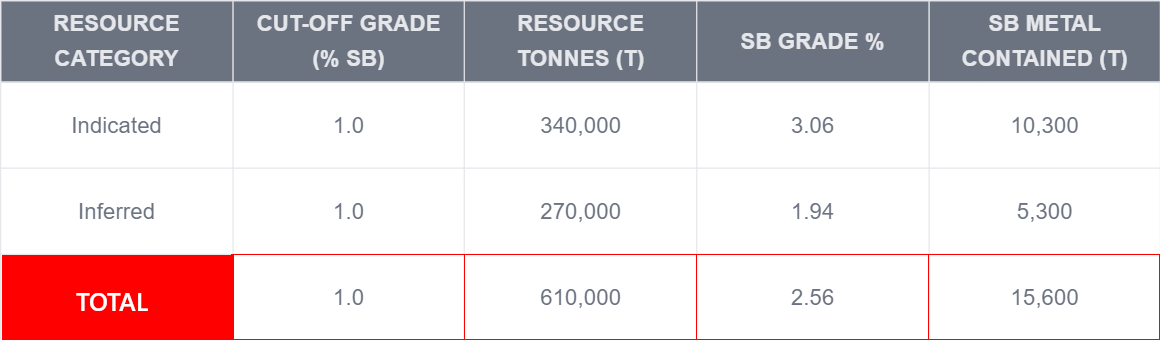

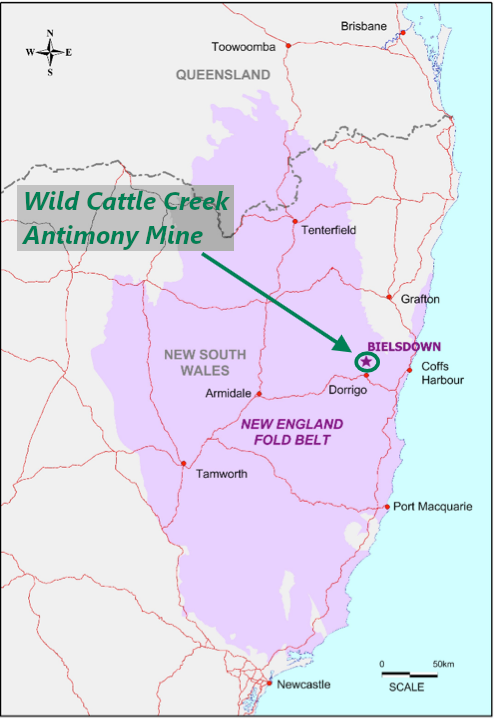

The Achilles project, an Antimony deposit located 13 kilometres north of Dorrigo in the southern segment of the New England Orogen, northern New South Wales, includes the Wild Cattle Creek Antimony mine.

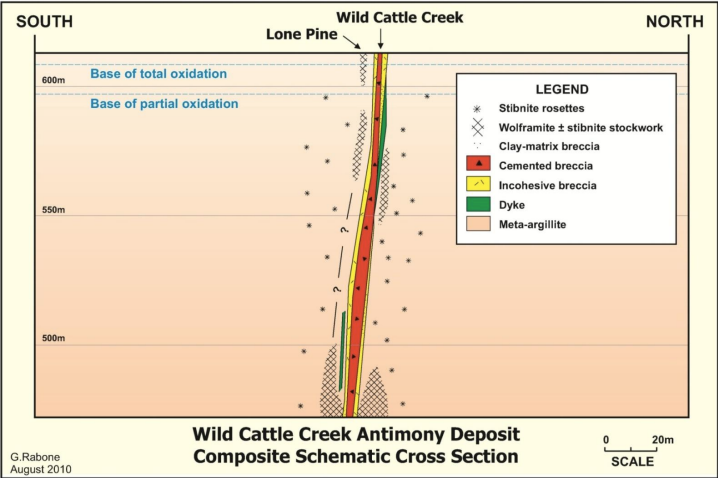

Discovered in the late 1800s, the mine was intermittently operated on a small scale until the 1970s. The deposit is hosted by a sub-vertical fault breccia within a sequence of metasediments, with a high-grade Antimony-rich core contained in a cemented (silicified) stibnite-rich breccia.

The project is situated 40 kilometres from the major population hub of Coffs Harbour and 90 kilometres northeast of the regional centre of Armidale.

The first mining license applications for the Wild Cattle Creek mine date back to 1890, with Gold and Tungsten discovered in 1927.

Dundee Mines operated the site from 1963 to 1975, and in 1971, they sunk a shaft to 165 meters and extended an adit to 366 metres, along with open-cut workings of 7-10 metres.

The mine was later operated by Allegiance Mining from 1992 to 1998, during which they undertook metallurgy, mine design, and environmental studies.

In 2007, the project was acquired by Anchor Resources, who conducted further exploration and released a scoping study in 2011. Anchor upgraded the resource to JORC 2012 compliant in 2013.

Deposit Geology and Mineralisation

The Wild Cattle Creek antimony deposit is a structurally controlled deposit hosted by a steeply south dipping regional east-west trending strike-slip fault in turbiditic metasediments of inferred Late Carboniferous age. The deposit is enriched in antimony, tungsten, gold, arsenic, mercury,

sulphur, and depleted in manganese and potassium. The deposit is hosted by a regional sub-vertical fault within a sequence of fine grained metasediment.

sulphur, and depleted in manganese and potassium. The deposit is hosted by a regional sub-vertical fault within a sequence of fine grained metasediment.

The high grade antimony-rich core of the structure contains coarse-grained stibnite (antimony) mineralisation and is associated with a cemented cohesive (silicified) fault breccia.

The cohesive breccia is surrounded by an in-cohesive fault breccia consisting of metasediment clasts.

On both sides of the fault structure, lower grade stibnite (antimony) mineralisation can be found in stringer style vein mineralisation together with minor amounts of vein hosted wolframite (tungsten) mineralisation.

The deposit is exposed at surface for over a length of 300 metres and plunges approximately 25˚ westerly. It extends down plunge for over 350 metres where mineralisation remains open to the west.

Tungsten and Gold

Tungsten and Gold

Gold mineralisation is primarily found within the cohesive fault breccia, which also hosts the high-grade antimony core. In contrast, the in-cohesive fault breccia contains lower-grade occurrences of gold.

Tungsten mineralisation is less prevalent in the cohesive fault breccia that holds the high-grade antimony and better gold grades. Instead, tungsten levels are elevated in the peripheral stringer zone, which is rich in wolframite veins.

Mineral Resource Statement (2012 JORC Compliant)

The 2012 JORC code compliant mineral resource statement for the Wild Cattle Creek Antimony deposit is based on data from 130 surface diamond and percussion drill holes and 43 underground drive face samples.

The surface diamond and percussion drill holes total 10,710 metres. The total (I+I) Au (Gold) grade is 0.32 (g/t) and W (Tungsten) 269ppm.

Notable Drill Intersections

➤ Hole DDH6 intersected 10.1m at 5.1% Sb

➤ Hole DDH16 intersected 22.5m at 3.9% Sb

➤ Hole P215 intersected 8m at 3.91% Sb

➤ Hole D114 intersected 12m at 4.43% Sb

➤ Hole D115 intersected 10.8m at 9.28% Sb

➤ Hole D119 intersected 10.7m at 14.24% Sb

➤ Hole D122 intersected 12m at 3.22% Sb

➤ Hole 09WRD01 intersected 11.5m at 2.32% Sb

➤ Hole 09WDD03 intersected 20m at 2.65% Sb

➤ Hole 09WRD04 intersected 10m at 3.48% Sb

➤ Hole 09WRD07 intersected 4.4m at 3.19% Sb

➤ Hole 09WRD10 intersected 6.8m at 2.57% Sb

➤ Hole 10WDD11 intersected 18.7m at 4.46% Sb

➤ Hole 10WDD12 intersected 14.1m at 2.31% Sb

➤ Hole 10WRD15 intersected 51.2m at 1.7% Sb

➤ Hole 10WRD16 intersected 1.4m at 17.1% Sb

➤ Hole 10WRD16W intersected 2m at 14.5% Sb

➤ Hole 10WRD17 intersected 8m at 2.8% Sb

Resource Expansion

The Wild Cattle Creek Antimony deposit remains open down-plunge to the west and along trend of the Bielsdown Fault, with Stibnite mineralisation being identified along a 6km strike, suggesting significant exploration potential.

The current mineral resource statement of 610,000 tonnes at 2.56% Sb (antimony), amounting to 15,600 tonnes of contained Sb, is based on only 10,710 metres of drilling.

Further exploration opportunities exist within the landholding, which also includes the historic Fletcher’s (Frying Pan) Antimony mine and the Graham-Navins Antimony workings—the latter being regarded as an extension of the Wild Cattle Creek mineralisation. These areas present promising targets for the discovery and delineation of additional Antimony resources.

The company will be in a position to aggressively explore the existing Wild Cattle Creek Antimony deposit in addition to other potential Antimony mineralisation within the Achilles project landholding (EL6388), using systematic and modern exploration methods that have not been comprehensively applied to date.

Such methods may include:

- Geophysical surveys

- Induced Polarisation (IP): Effective in detecting conductive sulphides such as Arsenopyrite which is a good indicator of Stibnite mineralisation in the Wild Cattle Creek deposit.

- Gravity Survey: Cemented breccia, which contains the high grade Stibnite core of the project, is denser than surrounding rock types. Gravity surveys can detect density contrasts, potentially identifying additional cemented breccia bodies.

- Geochemical sampling

- Rock and soil: Detect surface geochemical anomalies of pathfinder minerals such as antimony, arsenic, gold and mercury which assist in identifying new or potential extensions to existing mineralisation.

Antimony’s Critical Applications

Antimony is a rare metalloid with vital applications across a range of industries, including:

Solar panels coated with Antimony

- Flame retardants

- Batteries and energy storage

- Alloys for increasing material strength and durability

- Electronics manufacturing

- Catalysts in the chemical industry

- Pharmaceuticals and medical devices

- Glass and solar cells

The key strategic importance of antimony lies in its utilisation in various military applications, including:

- Hardeners for lead in ammunition

- Armour-piercing ammunition

- Tracer ammunition

NATO Ball ammunition with lead core and Antimony

- Nuclear weapons production

- Strengthening alloys used in military equipment and vehicles

- Infrared sensors and night-vision technology

- Precision optics

- Electronic components in military-grade electronics and communication systems

- Laser sighting

- Flares

- Military clothing

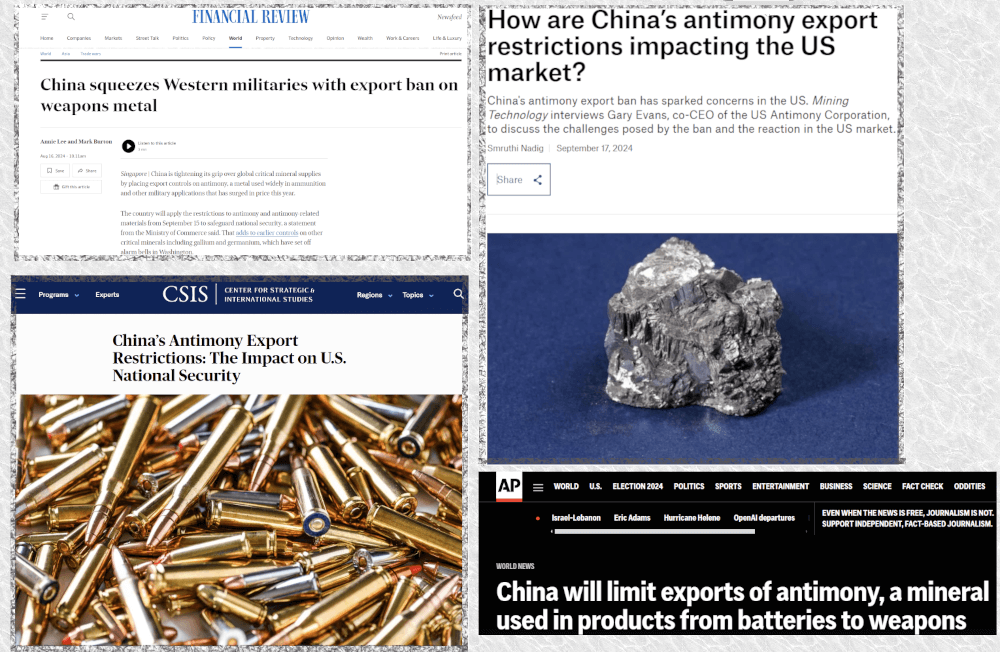

China’s Antimony Export Ban

China’s ban on the export of antimony ore, concentrate, metal, oxide, chemicals, and associated technology, imposed on 15 September 2024, presents a significant obstacle for Western manufacturing, particularly in defence and green energy sectors.

Antimony is crucial for flame retardants in military gear and armour-piercing ammunition, while playing a key role in energy generation and storage technologies, such as solar panels and advanced batteries for renewable energy systems.

With China controlling 48% of the global antimony production and 63% of U.S. Antimony imports, this export restriction disrupts supply chains, leading to increased costs and production delays. For the West, this could slow green energy initiatives and hinder military munitions and equipment production, creating strategic vulnerabilities in both sectors.

Surging Antimony Price

Antimony prices have soared to record highs due to a combination of China restricting exports, rising demand, and a general decline in global production, particularly from China.

Antimony prices trade at record highs following China’s supply ban

China’s antimony production fell to 40,000 tonnes in 2023, down from 61,000 tonnes in 2020—a significant 34% reduction. This drop has been driven by declining ore grades and stricter environmental regulations in the country.

At the same time, antimony’s importance has grown, especially with the Ukraine-Russia and Israel-Palestine conflicts, where it is crucial in military applications ranging from ammunition to essential equipment.

The United States and European Union have reported severe ammunition shortages, compounded by ongoing supplies to Ukraine. With China’s export ban effectively removing 48% of the global antimony supply, Western nations are facing increasing pressure to secure antimony supply for military purposes.

Antimony’s Strategic Impetus

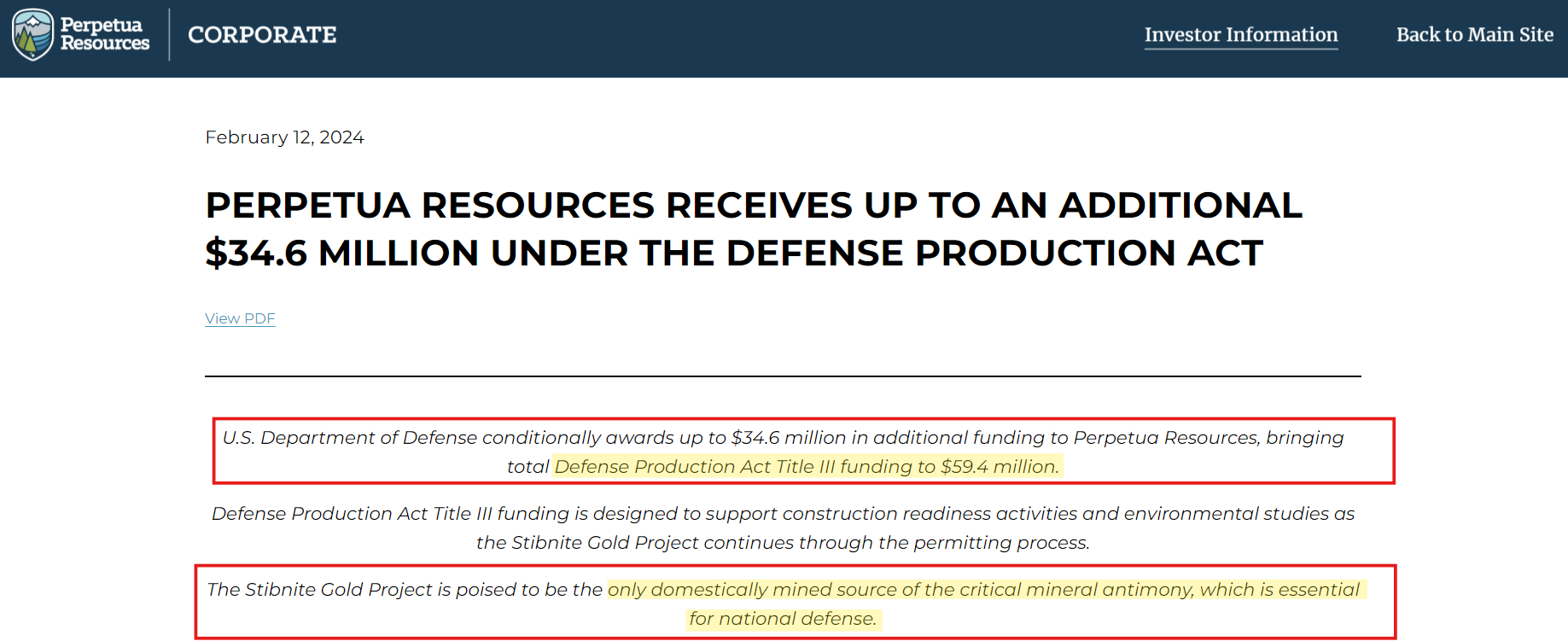

In line with the outlined military strategic applications, the critical role of antimony in sustaining the military-industrial complex cannot be overstated. Recognising this, the United States federal government has deemed it imperative to provide financial support and facilitate the development of West-aligned antimony deposits to ensure a continuous and reliable supply.

One such example of the recipient of federal government funding is Perpetua Resources (PPTA.O), who are progressing their Idaho based Stibnite Gold project that contains 104Mt for 67,131 tonnes of Stibnite at 0.06% (Proven & Probable Mineral Reserves).

In addition to funding under the Defense Production Act, Perpetua Resources have received a letter of interest from the US. Export-Import Bank (EXIM – the

official export credit agency of the United States federal government) for a loan worth up to US $1.8 billion to develop their Stibnite-Gold project in Idaho and ensure supply of Antimony.

Perpetua has received US $75m in federal government grants to date.

The willingness and urgency demonstrated by the federal government to provide funding for project progression and development demonstrates the strategic value of Antimony.

Adopting the same approach to Antimony as the United States, the governments of Australia, European Union, India, Japan, Republic of Korea and the United Kingdom have designated Antimony as a critical mineral.

The opportunity exists for Trigg Minerals to seek government funding through the Australian government’s $4 billion Critical Minerals Facility (Export Finance Australia), to advance the Achilles project containing the Wild Cattle Creek Antimony deposit into feasibility studies and potential production.

Recent examples of funding through the Critical Minerals Facility include:

- A$500m loan to Arafura to develop the Nolans rare earths project. (14 March 2024)

- A$400m loan to Alpha HPA to develop a high-purity Alumina (HPA) processing facility. The funding was provided jointly with NAIF. (17 April 2024)

- A$185m loan facility for Renascor Resources to progress their Siviour graphite project in South Australia (15 May 2024)

Alongside the efforts by the Australian federal government, New South Wales has launched its own local initiative, known as the “NSW Critical Minerals Strategy.” This program specifically offers funding support for early-stage critical mineral exploration projects.

The NSW Critical Minerals and High-Tech Metals Strategy is the Government’s blueprint for unlocking the state’s potential in minerals such as scandium, cobalt, zinc, antimony, heavy mineral sands (titanium-zirconium-rare earth elements), magmatic zirconium, platinum group elements and tungsten. The Critical Minerals Strategy sets out the Government’s coordinated approach to building a strong critical and high-tech metals sector across the entire value chain, including supporting the industry from early-stage exploration.

Furthermore, due to the rarity of delineated Antimony resources, funding may be sourced from other Western governments or their defence industries.

Antimony is considered one of Australia’s critical minerals

Under the single point of entry (SPE) arrangement between the Australian government’s export finance australia (critical minerals facility) and the U.S. government’s EXIM bank, which allows for collaboration and joint financing, two Australian companies have received financing proposals recently from EXIM.

Meteoric Resources (ASX: MEI) for their Caldeira Ionic Rare Earths project to the tune of US$250m and Anson Resources for US$330m to build a Lithium production plant in Utah.

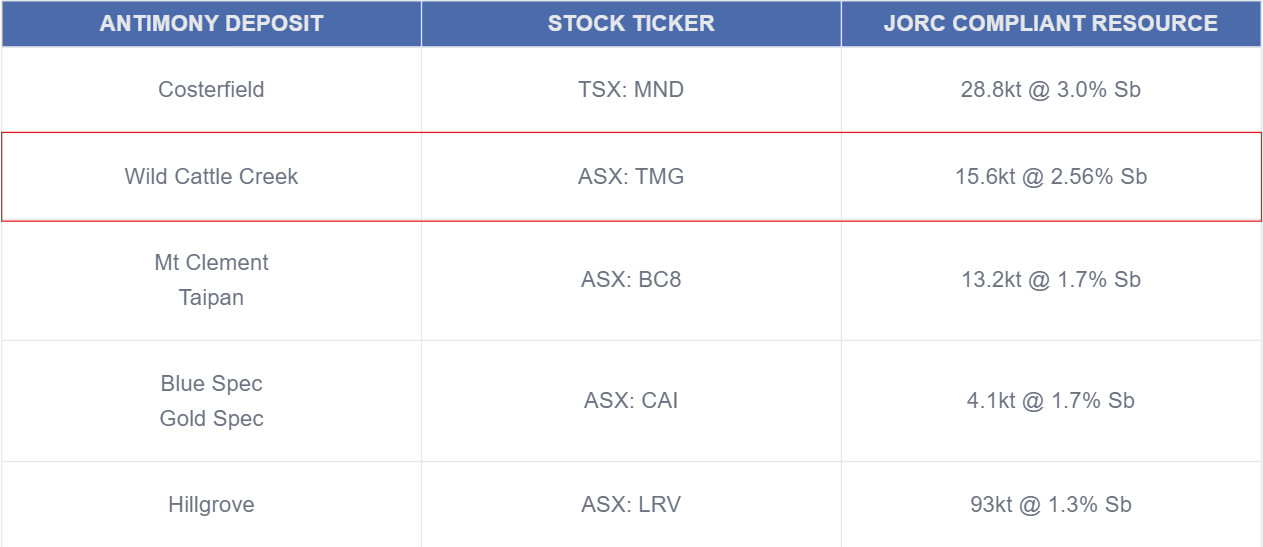

Australia’s Antimony Deposits

Further highlighting the scarcity and strategic imperative of antimony in Australia, there are only 5 JORC Compliant antimony deposits in Australia for a total of 154.7kt of Sb.

Wild Cattle Creek is the highest grade undeveloped antimony JORC Compliant deposit in Australia and the second highest grade antimony deposit, when factoring antimony deposits currently in production.

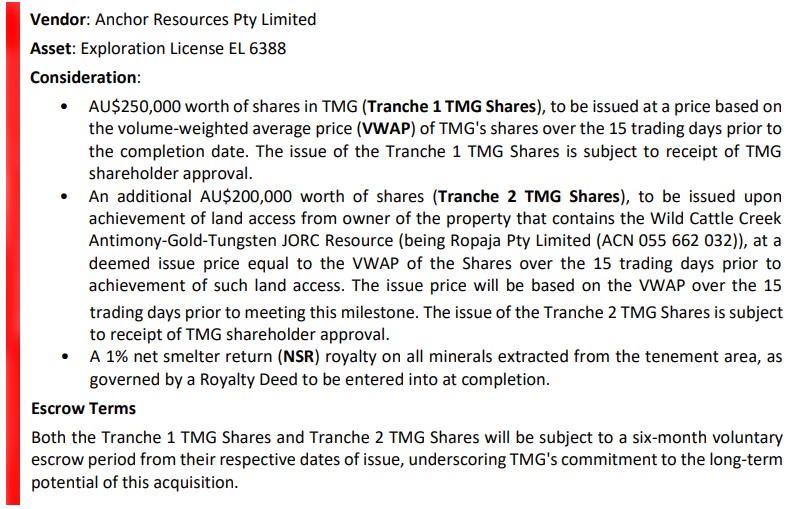

Acquisition Cost

The consideration for the acquisition:

Total consideration: $450,000 equivalent of Trigg Mineral shares, subject to six-month voluntary escrow.

A legitimate question to ascertain, why would Australia’s highest grade undeveloped antimony resource be acquired for a relatively small sum? The answer lies in Anchor Resources, the vendor of the project.

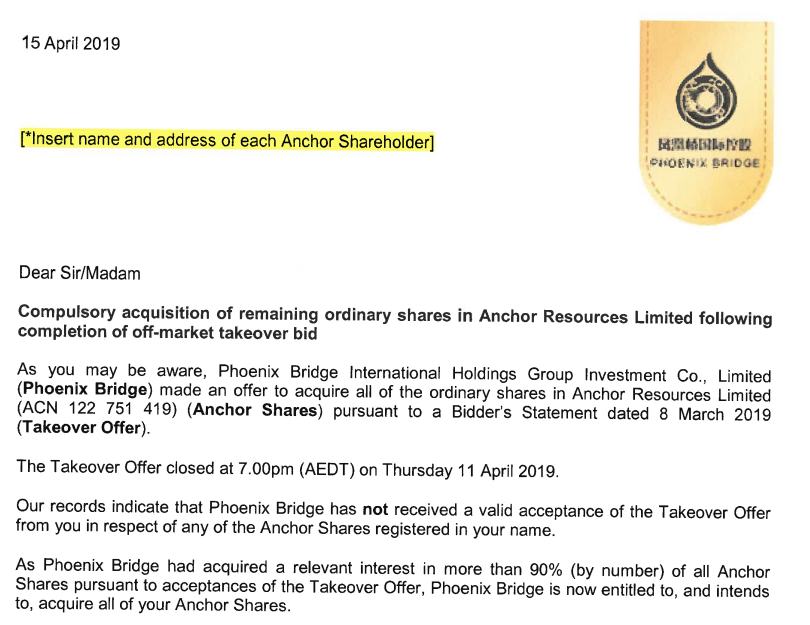

Chinese backed Phoenix Bridge International Holdings Group Investment Co., acquired Anchor Resources and the Bielsdown (now Achilles) project in 2019

Anchor Resources is controlled by Phoenix Bridge International Holdings Group Investment Co., Limited (PBIH), which is a Hong Kong based, Chinese controlled entity. PBIH acquired publicly traded Anchor Resources in 2019 through compulsory acquisition after acquiring 90% of relevant shares on issue.

Factoring in the current strategic impetus of antimony and China’s export ban on antimony, It would not be feasible for Anchor Resources, being Chinese owned, to progress an Australian antimony deposit into production while China bans the export of antimony and related products to Australia.

CONCLUSION

The acquisition of the Achilles project and Wild Cattle Creek Antimony mine is exceptionally value accretive for Triggs Minerals on the basis of antimony’s increasingly strategic value and dwindling supply.

There is potential to increase the current Wild Cattle Creek resource and discover additional antimony resources on the landholding acquired.

With global geopolitical tensions escalating, marked by ongoing military conflicts in Europe and the Middle East and a rising risk of broader confrontation, antimony’s critical role in military and defence applications will only grow in importance.

Given this context, the significance of securing antimony supply for military purposes, there may be opportunities for government assistance, either through the Critical Minerals Facility or via the SPE established between Export Finance Australia and the U.S. Export-Import Bank (EXIM).