by admin

Share

by admin

Share

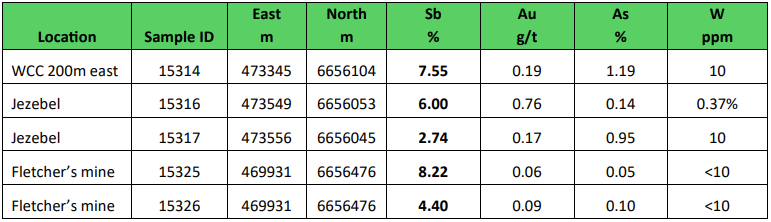

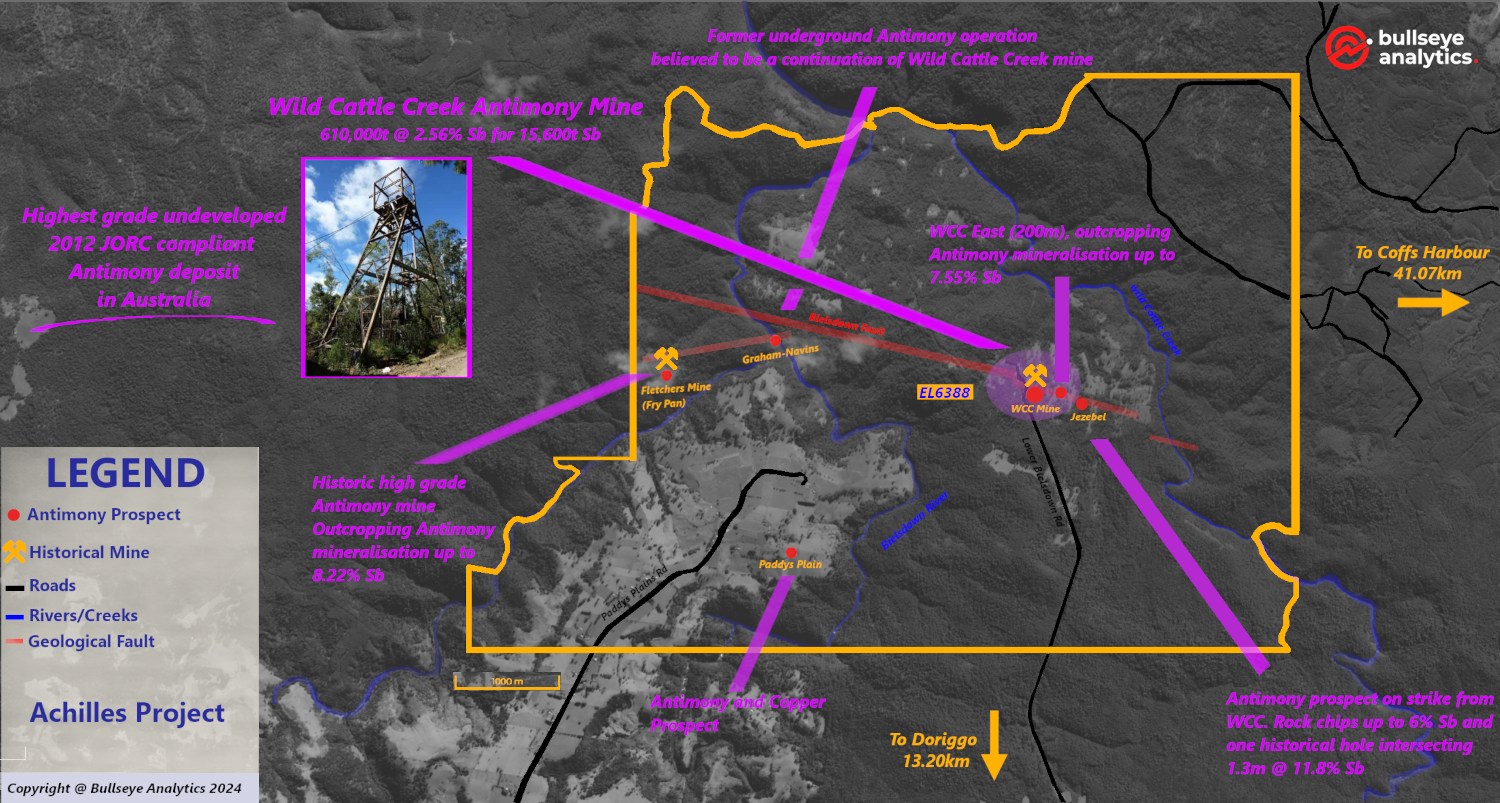

Trigg Minerals has moved promptly to evaluate historical data from the Achilles Project, which includes the Wild Cattle Creek Antimony deposit. Avenues have been determined to enhance the existing resource while identifying ways to expand the resource footprint across the entire landholding which is prospective for Antimony mineralisation.

The Wild Cattle Creek deposit stands as Australia’s highest-grade undeveloped JORC compliant Antimony deposit. Unlike the majority of deposits globally where Antimony is merely a by-product of Gold, Silver, Copper, or Zinc extraction, Wild Cattle Creek positions Antimony as the primary mineral, making it a globally significant resource of strategic importance. This distinction strengthens the case for government support under current critical minerals funding schemes.

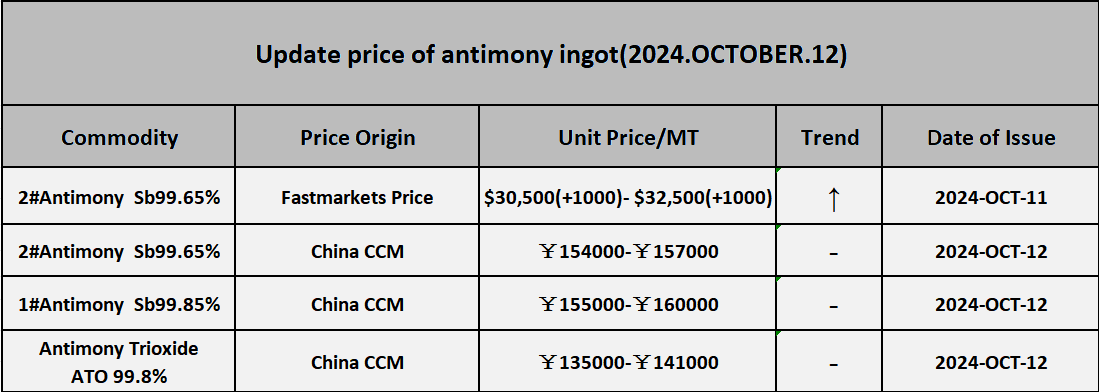

Antimony prices continue to surge

The Antimony price has continued to surge due to increasing demand and constrained supply with Fastmarkets reporting prices between $30,500 and $32,500 USD per metric tonne on October 11. This would equate to between $45,700 AUD – $48,700 AUD at current exchange rates, increasing the value of the Wild Cattle Creek resource (15,600t) considerably.

Expansion of existing resource

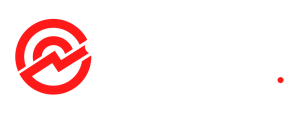

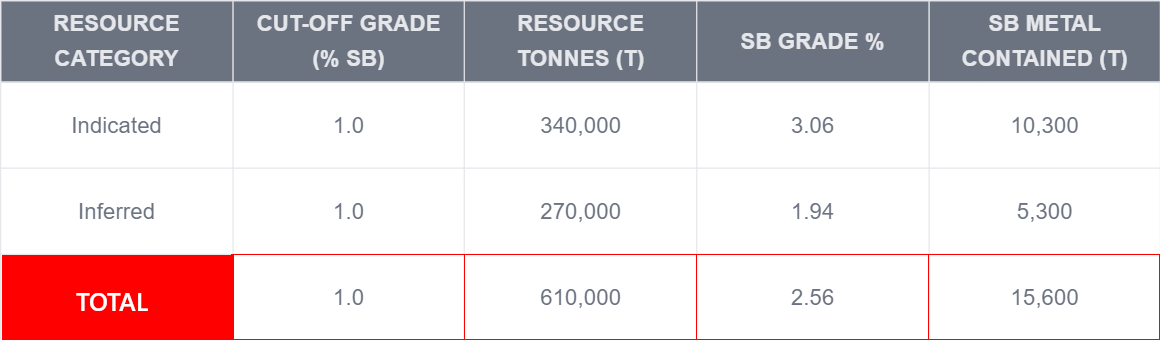

The JORC Compliant Mineral Resource Estimate (MRE) was based on Antimony prices of $10,000 USD per metric tonne, leading to the application of a 1% cut-off grade.

With current Antimony prices averaging around $30,500 USD per metric tonne (approximately $45,700 AUD), the cut-off grade can be reduced, increasing the total quantity of contained Antimony.

2013 Mineral Resource Estimate by SRK Consulting

The company has announced that access to the project has been granted and exploration targets to the West of the Wild Cattle Creek deposit, are available for immediate exploration pending APO (Assessable Prospecting Operation) approval.

Funding secured

Funding has been secured through a placement to the market totalling $2.5m. The funding was cornerstoned by several large Australian and international institutions.

Per the announcement from Trigg Minerals, the funding will be used for:

- Exploration and drilling programs at the recently acquired Achilles, Taylors Arm and Spartan Antimony projects

- Exploration and drilling at the Drummond basin gold projects

- Working capital and transaction costs

- Due diligence costs for potential acquisitions

The company stated that it had received substantial demand for the placement from interested market participants.

At the end of the July quarter, the company had $1.561 million in cash and received a further $301,435.12 and $200,000 in funding through the 2nd tranche placement and additional commitments being received.

The relatively small placement size is indicative that the company is confident of securing funding with less dilution after undertaking exploratory work on the newly acquired Antimony projects.

“We are thrilled with the overwhelming response from both strategic investors and global funds, which

reinforces the market’s confidence in our business strategy.

This capital injection gives us a strong financial platform to continue delivering on our plans and

creating shareholder value. We look forward to capitalising on this momentum as we advance our

projects.”– Tim Morrison, Executive Chairman of Trigg Minerals,

Access granted, priority areas available

Trigg has confirmed access to the Achilles project and and amended the acquisition agreement, for all consideration of TMG shares to be issued at completion, pending shareholder approval.

Additionally, the company has identified several priority areas immediately within the resource area and its extensions, particularly west towards the historic Fletchers mine, that are available for immediate exploration and drilling subject to APO (assessable prospecting operation approval).

The company has commenced the process of selecting areas for field work and potential drilling targets.

The Achilles project and its landholding has been previously subject to drilling by former operators Dundee Mines/AAC (1963-1975), Allegiance Mining (1992-1998) and Anchor Resources (2007-2024). The landholding does not sit within a national park or mining restrictive area and there should be no obstacles to obtaining APO and relevant permitting.

Disclaimer: Bullseye Analytics (the company) or associated entities own 150,000,000 TMGOD options as of the publication date of this article.