by admin

Share

by admin

Share

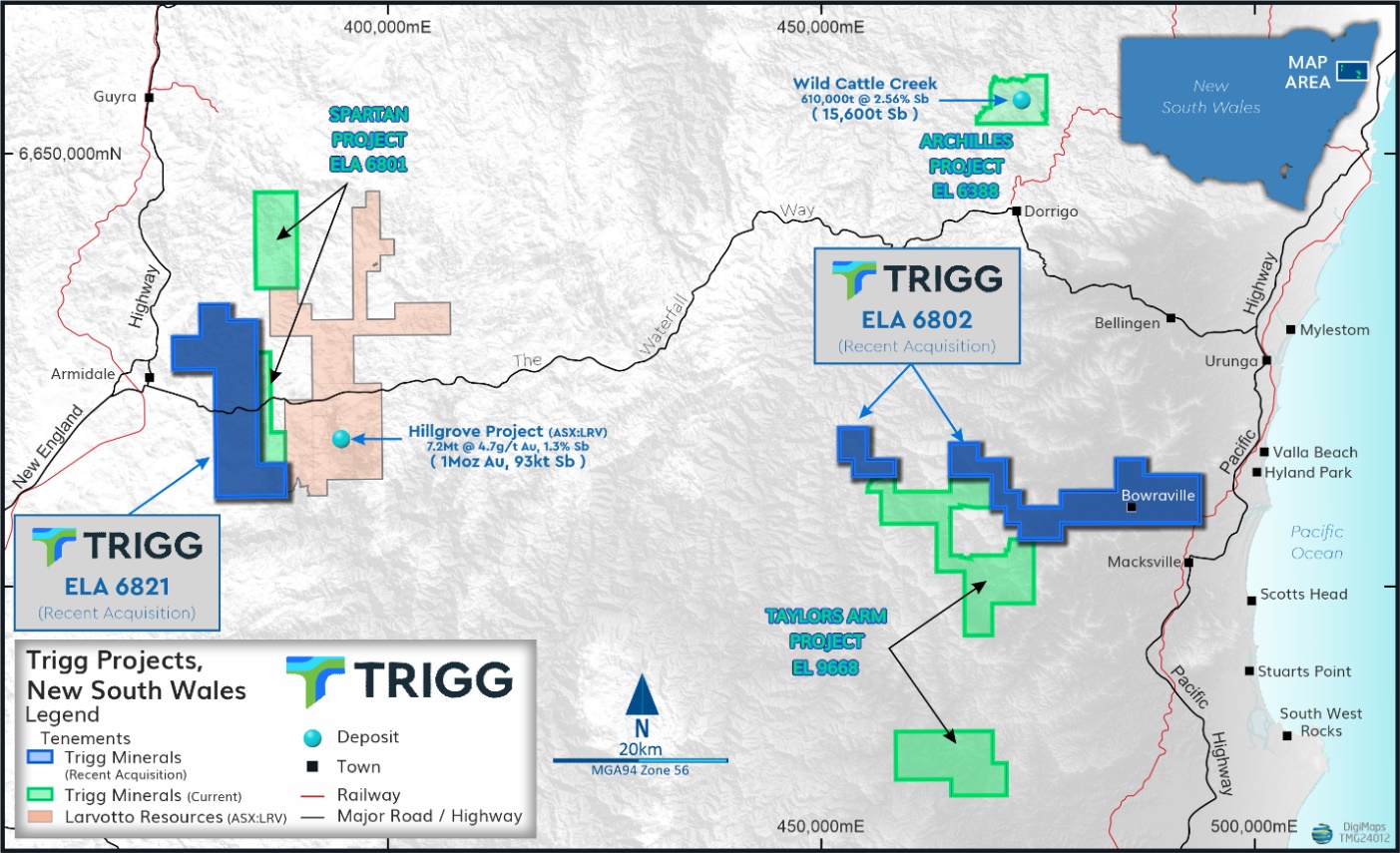

Trigg Minerals has entered into binding purchase agreements to acquire the Spartan West and Taylor’s Arm East Antimony applications (ELAs 6821 and 6802).

The projects are located in the New England Orogen (NEO) in Northern NSW and compliment the existing landholding, consisting of the Spartan, Taylors Arm and Achilles projects.

The acquired landholding is considered highly prospective for Antimony ± gold/silver mineralisation.

Acquisition of ELA 6821 and ELA 6802

Spartan West Antimony Project

The Spartan West application (ELA 6821) is located adjacent to Larvotto Resources Ltd’s (ASX: LRV) licenses, which contain their Hillgrove Antimony-Gold operation. The Spartan West project contains several Antimony Gold occurrences and covers parts of the Hillgrove Fault and the same rock formations that host the Hillgrove Antimony-Gold deposit. The application contains several historical exploration prospects for Antimony, Gold, Silver and Manganese.

Taylors Arm Antimony East Project

The Taylors Arm Antimony East Project adds 16 additional workings to the Taylors Arm Antimony project, totalling 87 historical Antimony mines, most of which produced high-grade Antimony.

The acquired landholding (ELA 6802) lies immediately north of the Trigg’s granted upper Taylors Arm partition. Sixteen historical workings are distributed across the application area. The Western partition of the application contains three historical workings, including Keayes and Bull Creek that both report high-grade sulphidic-quartz breccia material (with grades exceeding 6% Sb and up to 57.9% Sb).

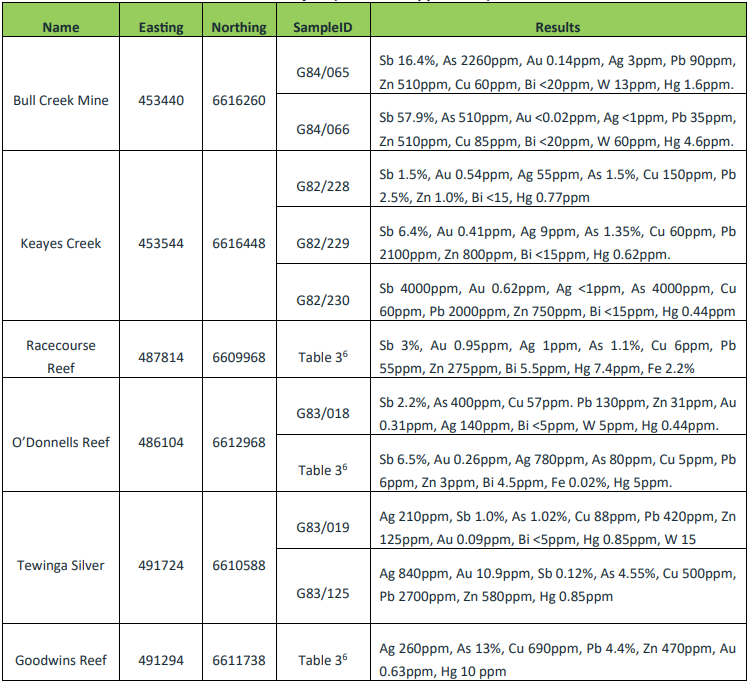

Keayes Creek: Five high grade Stibnite-bearing lodes identified within a 40-metre-wide shear complex. This shear system can be traced for at least 500 metres, indicating significant potential for further exploration of Antimony mineralisation. Rock samples from workings have returned up to 6.2 g/t gold.

Bull Creek Mine: An open-cut and underground Antimony mine developed along three distinct shear zones. Recent rock sampling undertaken at the site have confirmed extremely high-grade antimony mineralisation with assays returning values of 57.9% Sb and 16.4% Sb. Historically, Antimony was mined in multiple periods, with some operations yielding up to 50% Sb. Recent sampling has also yielded promising gold results, such as 6 g/t Gold and 24 g/t Gold. These findings suggest that, alongside its high-grade antimony, the area holds significant potential for gold mineralisation.

O’Donnell’s Reef: Underground workings, shafts and shallow pits, developed on a brecciated quartz shear zone featuring stibnite mineralisation with grades up to 6.5% Sb.

Tewinga Silver Mine: The Tewinga silver deposit offers significant tonnage potential, however, has only been subjected to limited exploration. The potential exists for a large Ag-Au deposit, highlighting the need for further exploration. The argentiferous lode can be traced at the surface for over a kilometre. Assays of lode material from early prospectors have shown significant variability, with hand-picked samples ranging from 31 to 5,939 g/t ag.

The mine was worked intermittently until 1935 where a 23.5t bulk sample of ore yielded 3,471oz of Silver at a grade of 147.7 ounces per tonne (equivalent to 4594 g/t ag). The mineralisation is traceable over 1200m in length.

Summary of rock samples collected by NSW Geological Survey from historic mines on the Taylors Arm East Project

Acquisition cost

ELA 6802 – Taylors Arm East

Consideration: 3,500,000 shares at a deemed issue price of $0.05 per share ($175k) in consideration for the acquisition.

Escrow terms: Six-month voluntary escrow from issue date.

ELA 6821 – Spartan West

Consideration: 1,000,000 shares at a deemed issue price of $0.05 per share ($50k) in consideration for the acquisition and $10,000 cash consideration paid to the vendor.

Escrow terms: Six-month voluntary escrow on the shares issued from the issue date.

Disclaimer: Bullseye Analytics (the company) or associated entities own 150,000,000 TMGOD options as of the publication date of this article.