by admin

Share

by admin

Share

Overview

✔ The upgraded Mineral Resource Estimate (MRE) reinforces Wild Cattle Creek’s status as a globally significant antimony deposit, particularly in an environment of growing supply constraints.

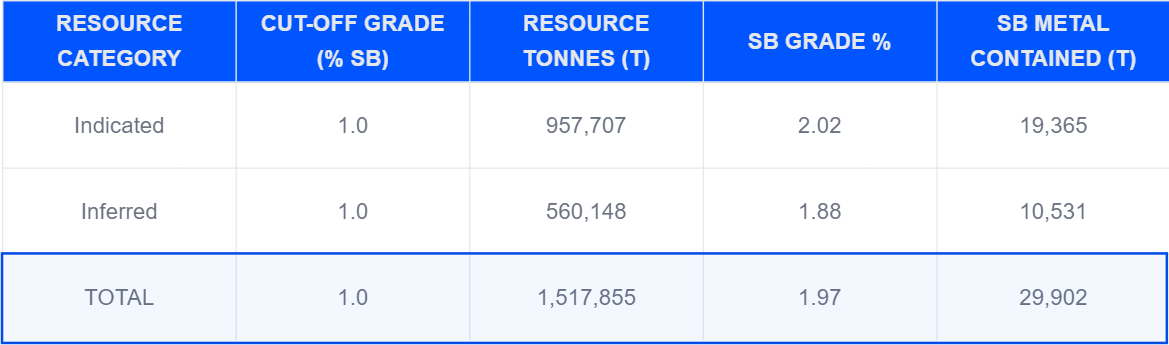

✔ The updated MRE of 1.52 Mt at 1.97% Sb, containing 29,902 tonnes of antimony, marks an approximate 92% increase compared to the 2013 estimate.

✔ Varied forms of stibnite mineralisation (cohesive and incohesive breccia, wolframite, and rosettes) contribute to an average across-strike thickness of 74 metres.

✔ The Wild Cattle Creek deposit has been drilled to an average depth of less than 100 metres and remains open down-plunge and along strike of the 6 km-long Bielsdown Fault, offering significant potential for resource expansion.

✔ Antimony prices reached a record high of USD $40,000 per metric tonne (approximately AUD $63,000) on 16 December 2024.

✔ On 3 December 2024, China reaffirmed its antimony export ban on ore, concentrates, and related products, originally imposed on 15 September 2024, suggesting a further hardening in stance. Strict penalties were introduced for violations by Chinese individuals and companies.

Resource Estimate Upgrade

Trigg Minerals has completed the updated Mineral Resource Estimate (MRE) for the Wild Cattle Creek (WCC) deposit, part of the Achilles Project (EL 6388).

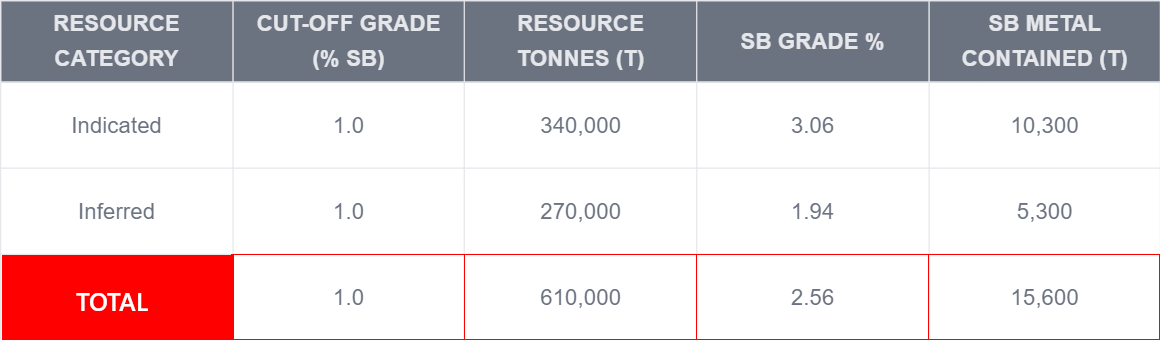

The previous MRE, conducted by SRK Consulting (Australasia) in 2013, outlined a resource of 15,600 tonnes of contained antimony at a grade of 2.56% Sb, based on a 1% cut-off.

2013 maiden resource estimate for Wild Cattle Creek undertaken by SRK Consulting

Trigg Minerals engaged H&S Consultants (HSC) to upgrade the Mineral Resource Estimate, addressing the omission of peripheral mineralisation in the initial estimate by SRK Consulting.

The peripheral mineralisation comprises lower-grade stibnite hosted in wolframite stringer zones and stibnite rosettes, situated around the cemented and incohesive breccia core.

2024 maiden resource estimate upgrade undertaken by H&S Consultants

The Wild Cattle Creek (WCC) antimony Mineral Resource Estimate, prepared by HSC in December 2024 in accordance with the 2012 JORC Code, is based on 120 surface drill holes, totalling 9,538.6 metres.

Mineralisation at WCC is evident on the surface through old shafts, trenches, and prospecting pits, extending over a strike length of 900 metres. Since 1964, shallow drilling has been conducted along a 700-metre strike length, with the majority focused on a 300-metre section to depths of less than 200 metres below the surface.

The MRE covers a strike length of 600 metres, with a plan width varying between 2 and 25 metres. The deposit outcrops at surface and extends to a depth of approximately 200 to 250 metres. Evidence indicates that the mineralisation remains open at depth and along strike to the east and west.

Exploration potential to delineate additional resources exists primarily at depth and along strike of the Bielsdown fault.

Antimony Market

The antimony price reached a record high of USD $40,000 (AUD $63,000) on 16 December. The ongoing price increases are being driven by several factors, including:

- China’s antimony export ban on ore, concentrates, and related products, introduced on 15 September 2024 and reaffirmed on 3 December 2024, has led to a 97% decline in the country’s antimony exports since its implementation.

- China is experiencing declining antimony reserves and grades. Reserves have decreased from 950,000 tonnes in 2014 to 640,000 tonnes in 2023, while domestic production has dropped from 89,000 tonnes in 2019 to just 40,000 tonnes in 2023.

- China has been compelled to compete in the international market for antimony supply, despite a globally constrained market. The country imported 26,000 tonnes of antimony in 2022 and 28,000 tonnes in 2023. In 2024, antimony imports are projected to have risen by 37.6% from January to July.

- Tight supply is being met with surging demand, driven primarily by the photovoltaic sector, which accounts for 50,000 tonnes of demand annually and is expected to grow by 30% year-on-year. Military applications, fuelled by ongoing conflicts in Europe and the Middle East, are further boosting demand. Fire retardant applications remain steady, while calcium-antimony liquid batteries represent an emerging market.

- Antimony reserves in the United States National Defense Stockpile (NDS) dropped to just 1,100 tonnes in 2024. In 2023, the U.S. consumed 23,000 tonnes of antimony, with demand projected to rise to 30,000 tonnes in 2024.

- The antimony deficit in China for 2024 is estimated to be 33,000 tonnes.

- The western supply of antimony has become increasingly uncertain following the closure of Canada’s Beaver Brook antimony mine in January 2023 due to ore depletion. This was compounded by the suspension of operations at the SPMP antimony smelter in Oman, the largest facility outside China, due to a lack of feedstock.

- The Mandalay Resources Costerfield mine in Victoria, Australia, is currently the only western-facing antimony mine in production. However, it is projected to produce just 1,100 to 1,500 tonnes of antimony in 2024.

Disclaimer: Bullseye Analytics (the company) or associated entities own 150,000,000 TMGOD options as of the publication date of this article.